Market Thoughts: It’s a Mad, Mad, Mad, Mad World

“We do not have to visit a madhouse to find disordered minds; our planet is the mental institution of the universe. A man can stand anything except a succession of ordinary days. By seeking and blundering we learn. There is nothing more frightful than ignorance in action.” — Johann Wolfgang Von Goethe

“Ludacris, yes, what do you mean Logic retired in July?” was a dear friend’s response to the teenager who went on a Logic gear shopping spree. And as it turns out both Ludacris (Fast & Furious fame) and Logic are American rappers but she may as well be talking about the markets because it looks like logic retired in July and there is no better time for his retirement in a mad, mad, mad, mad world.

There is no better time as well to pay tribute to the perils of human greed in the 1963 comedy, It’s a Mad, Mad, Mad, Mad World as we end July on all-time monthly closing highs in the S&P 500, 10Y US Treasury price and Gold, alongside record highs in unemployment, Covid-19 cases and deaths. What better recipe can we ask for in a lesson on madness?

What a well and truly mad week it has been with Donald Trump ending the week proclaiming “nobody likes me” as the Covid-19 death toll broke 150,000 and cases near 5 million after he tweeted about postponing the election and denying his intentions.

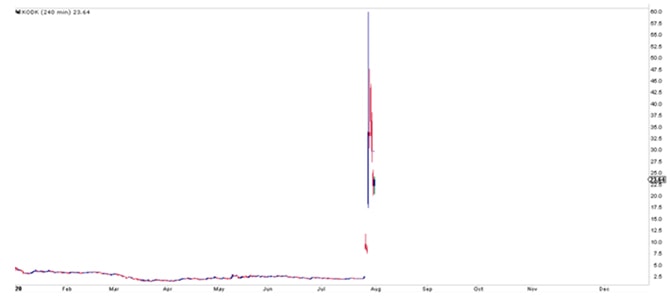

Then we had the Kodak moment in Kodak shares that leapt 2,400 per cent in two days after it won a government loan to help produce ingredients used in medicines to fight the coronavirus yet $10,000 invested in Kodak at its high on Wednesday would be worth less than $4,000 by the week’s end.

Yet, unlike Fujifilm, which has been in the drug business as early as 1986 with 43 per cent of revenues from healthcare solutions, Kodak is just in the infant stages of creating a start-up for a “company which has been out of the drug business for decades” but somehow managed to reward its CEO and directors tens of millions one day before the announcement of government backing, in a blatant case of crony capitalism, third-world style.

Chart of Kodak Eastman share price taken from Sven Henrich on Twitter

Chart of Kodak Eastman share price taken from Sven Henrich on Twitter

It is unfortunate that Kodak had to tank 26.75 per cent on Friday because as of Thursday’s close, there were more Robinhood users who owned Kodak than the S&P 500, according to Robintrack.

Is it the Madness of Robinhood That Logic Retired in July?

Charles Schwab, TD Ameritrade, Etrade and Robinhood—together saw more than 4.5 million new accounts in the first three months of the year; China added new investors at the fastest pace in 14 months (up 47 per cent) and; retail trades jump to a record in India.

The WSJ reports that retail accounts for a fifth of all stock market activity and a quarter during the busiest sessions now as everyone’s a day trader as “bored, isolated and out of work amid the pandemic, millions of Americans are chasing stock-market glory—and bragging about it online.”

“I had my 18-year-old niece asking me what stocks she should invest in because her friends are making 30 per cent per day,” Mark Cuban said in an interview on CNBC. But his warnings against being greedy will go unheeded by many because “scared money makes no money,” says one newly minted trader who read Investing for Dummies just a few months ago.

And there is no bigger icon (or enfant terrible, depending on who you speak to) for the Robinhood generation than Dave Portnoy, the founder of Barstool Sports, with over 1.7 million followers on Twitter. Portnoy claimed he was better than “washed up” Warren Buffet, famously stock picks with Scrabble tiles, recently boasting that $250k returns are not good enough on July 30 and acknowledges that he “accidentally” spends $150k on a stock that he knows nothing about.

Source: Twitter

Source: Twitter

Stock trading has been gamified. Look at the success stories are out there after the fastest melt-up we had in the history of markets from March lows with stocks, commodities and bonds posting phenomenal returns. Even bankrupted companies like Hertz managed to eke out a 1,400 per cent rally in its stock immediately after filing for bankruptcy in June, as Portnoy promotes airlines stocks these days.

“Barclays examined trades by Robinhood customers between March and early June and concluded that the more they bought a specific stock, the worse that stock performed.”— WSJ, as reported on Zerohedge

The U.S. SEC chief frets about retail investors trying to get rich quick and not all succeed if we count those investors who had been long Kodak on Thursday’s close. Those who lose money would be “losers,” like the 20-year-old client of Robinhood who “took his own life after believing he incurred a large loss using the free trading app” and the newbie investors who cry foul that they did not know they would be losing money so fast.

It is a mad world when we read that the Robinhood crowd will be able to get their hands on CLOs (collateralized loan obligations) soon with the first CLO ETF in the works, and the theory that the internet has “democratized information that individuals could trade like pros” only goes so far, because the real pros still have the edge as CNBC’s Insana opined. It is evident some retail investors still cannot grasp the logic that bankrupted companies are not for trading as Bloomberg pointed out in their Distressed Daily: Which Part of “You Get Nothing” Isn’t Clear?, when the stock of newly bankrupt Ascena Retail Group rallied 120 per cent even after the announcement that existing common equity will be cancelled.

“It took me four months to learn everything I learned of the markets in my lifetime is now invalid.”— heard on Twitter

“Markets are, across the board, totally divorced from reality. Facts no longer matter.”— Jeff Gundlach

The Madness of Economic Reality?

“This is not a normal recession. The recessionary part of this you’re going to see down the road,” Jamie Dimon, CEO of JP Morgan, bemoaned on their exceptional quarterly earnings last week.

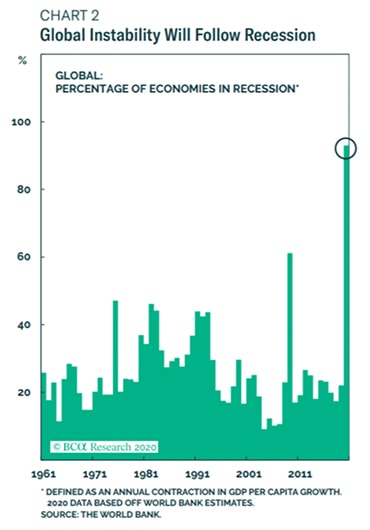

There is a definite disconnect between markets and the true state of the economy. Global trade has collapsed, declining 17.5 per cent YoY in May and nearly the entire world is in recession with millions of jobs lost and the layoffs are only expected to grow. The list goes on as the economic outlook dims and we cannot state them all with data worsening by the day in a mad disconnect from the stock market trajectory.

Source: Jeroen Blokland on Twitter

Source: Jeroen Blokland on Twitter

We can only empathise with the pros that logic has been retired after reading Market Review Q220: Calibrating the Craziness in Advisor Perspectives. Wall Street watcher Nomi Prins calls it a ‘Permanent Distortion’ where “the disconnect between financial assets, equity markets and the real economy has become massive” and yet Mike Green of Logic Funds summed that they “have reached the inevitable conclusion that no one is standing in the way of insanity. We are seeing this in our social lives where Cancel Culture has raised the stakes for anyone willing to stand in the way of the shaming mob, and we are seeing it in our public (and private) markets where any attempt to express rationality is met with underperformance and redemptions.”

The Madness of Central Banks?

The latest central bank to announce QE is Indonesia, in an outrageous move for an EM country that would have got them a dangerous downgrade anytime but now. For a country running twin deficits to audaciously decide to directly finance a budget deficit through its central bank, Indonesia managed to skirt the moral hazard with an assurance that it would be once-off.

It cannot be ignored that Indonesia’s US$27 billion in QE will be added to the trillions that have been printed this year as Fed Chair Powell confessed in May when he said, “We print money digitally. As a central bank, we have the ability to create money.” No hint at the possible moral hazard nor remorse for the Robinhooders who have been unlucky.

Nonetheless, QE is not making the world go round because liquidity does not create solvency as Citi’s Matt King said in a special Bloomberg Bankruptcy Breakdown, “You don’t become solvent by borrowing more money… What’s happening is zombification, where companies stay alive longer than they should, leading to less economic growth and higher unemployment rates over the longer term.”

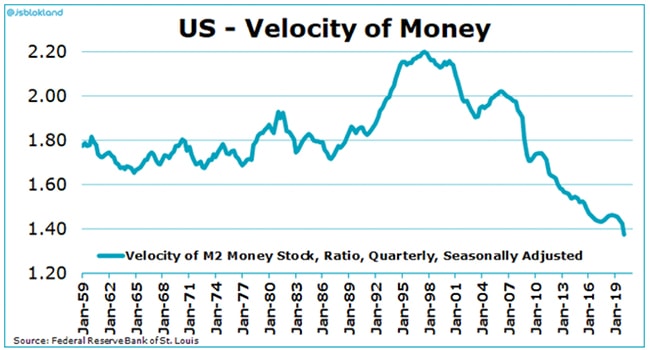

Indeed, examining the velocity of money shows banks are not in the driver seat of lending, perhaps because it is impossible to ascertain credit worthiness these days on all the bailouts, which screws up risk assessment models and large US banks have never had a higher percentage of cash and government securities than now.

Source: Jeroen Blokland of Robeco Advisors on Twitter

Source: Jeroen Blokland of Robeco Advisors on Twitter

Is it any wonder that Gold is at its all-time highs? If we compare 2-year yields, Bitcoin and Gold at 0.00 per cent would beat all of Europe, Japan and over 20 per cent of the US$60 trillion global bond market which trade at negative yields, with over 80 per cent of all developed market government debt under 0.5 per cent and where real yields (TIPS) on 10 year US treasuries close the mad month of July at -1 per cent.

“Investors are being infantilized by the relentless Federal Reserve activity. It’s as if the Fed considers them foolish children, unable to rationally set the prices of securities so it must intervene. When the market has a tantrum, the benevolent Fed has a soothing yet enabling response. As with the 30-year-olds still living in their parents’ basements, we can only wonder whether the markets will ever be expected to make it on their own.”— Seth Klarman, Baupost Group

One More Mad for the Road Ahead

Logic has retired but Ludacris is still around and we are pleased to find that Logic was guest vocals on our favourite, “Sucker for Pain,” from the Suicide Squad soundtrack.

It is a sign! Logic will be missed because Dragoneer Investment Group, another special purpose acquisition company (SPAC), will be filing an IPO for $600 million. SPAC’s are also known as blank-check companies (Private Equity funding vehicles for the masses) that caught the market’s eye after Bill Ackman’s Pershing Square Tontine Holdings Ltd., began trading this week after raising $4 billion to put him on the cover of Barron’s.

Source: Barron’s

Source: Barron’s

We would know enough about being suckers for pain, digging out that old memory back in 2000 when we marched into the banking hall holding our bonus cheques and demanded to buy unit trusts (before the advent of ETFs), flatly turning down the healthcare option in favour of tech and watching that little bonus evaporate away in a matter of months.

Maybe it is a sign that Logic (the rapper) retired in July. It is a Mad, Mad, Mad, Mad World!