Market Thoughts: Profiting From the Mistakes of Others

Sometimes you wonder if you made a mistake or are mistaken, as you drive down Lim Chu Kang Road and see steady streams of heaving cyclists braving what must be the unmistakable olfactory onslaught of the stench of fresh manure from the farms, or are we wrong? We have a mother who encouraged her son to strive hard in NS, only to wonder if she was mistaken as her friend boasted about her child succumbing to two weeks of vomiting, only to be excused from BMT—and now is about to have a free driving license.

For the waking dream we feel we have been living in, rolling out of bed and straight to work at home, half the year has passed and the economy is reopening. For many, it has been all about the mistakes made on Covid-19 and the usual infectious blame game because that is all Donald Trump indulges in.

To save ourselves unnecessary angst and heartache, let’s just say everybody makes mistakes. Whoever was in charge in China would not have known that the relatively unknown virus then was going to cause a global pandemic. And the unprecedented decision to lockdown a city and paralyse lives and economic activity. Who in Singapore would have had the acumen to realise that we would be plagued with a foreign worker outbreak? Oh, come on, give them a break.

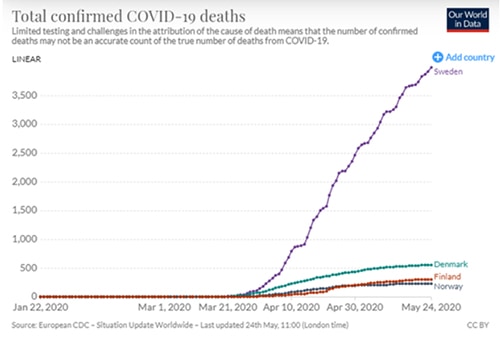

Did Sweden make a mistake? Sweden’s economy grew in the first quarter as it opted against a full virus lockdown, but suffered too many deaths as a result because they did not really know what they were dealing with, while the rest of the Nordic nations suffered economic damage for their lower death tolls, evoking a great debate within the schools of moral philosophy.

Is it a mistake that not a single economist surveyed could have predicted the positive jobs number of 2.5 million in the U.S. last week, when the consensus had been for job losses of 8.33 million? Yet it was not just about a single jobs number, but the riots, looting and fears of a second wave of Covid-19 that saw the Dow Jones Industrial Average gain 2,000 points last week and the S&P 500 proceeded to register a 5.89 per cent drop on June 11, which joins just 20 other days since 1997 where the index lost more than 5 per cent.

Days in the past 25 years where the S&P saw a larger than 5% drop

Days in the past 25 years where the S&P saw a larger than 5% drop

Perhaps the markets are indeed a series of human mistakes and errors of judgment and miscalculations.

What is “right” and what is “wrong”? And what is a mistake?

A true mistake would be the mystery of the Fangdd stock, a Chinese real estate firm that rose 1,250 per cent on Tuesday before closing 400 per cent higher which has been blamed on “Robinhood” traders, retail traders on the Robinhood platform who are accused of treating the stock market like a casino, buying into Fangdd (DUO US) when they should be buying FANG stocks (Facebook, Amazon, Netflix, Google) instead. The case is closed because the stock fell another 7 per cent Friday, back to its “pre-mistaken-identity” fiasco, which is not unfamiliar after the Zoom Technologies (ZOOM US) vs Zoom Video Communications (ZM US) fiasco that is still potentially causing confusion to the newbie investor.

Chart of Fangdd (DUO US) stock price over 30 days

Chart of Fangdd (DUO US) stock price over 30 days

And Hertz is up over 95 per cent since filing for Chapter 11, hitting a high of +1000 per cent from its lows on June 8, giving the company the nerve to raise US$1 billion in new capital after being served a delisting notice. This makes Hertz the first publicly bankrupted company to be able to raise potentially worthless capital in an unprecedented judgement. Another mistake in the making?

Source: Google

Source: Google

Hertz, Whiting Petroleum, JC Penney and the rest, even those planning to file for bankruptcy have defied logic and made handsome profits for daring Robinhood traders who do not see it as mistakes.

A friend confessed the mistake of buying the tripled leverage oil ETF, UCO US, when WTI Crude was around US$22 and sold it recently when the crude price was US$38 and still managed to realise a 20 per cent loss because these ETFs’ infamously caused negative oil prices in April and remained mired in controversy after filing for changes to the fund nine times since, tweaking its entire make-up and adding the right to options, forwards and OTC swaps to track the WTI contract.

Chart of UCO and WTI

Chart of UCO and WTI

“Just not doing anything stupid can put you in the top 50% of traders and investors.”—Steven Burns

Last week must have been a big mistake, when it was reported that speculative fervour in U.S. stocks surged to “stunning” levels with smaller traders making up more than 50 per cent of total volume last week, the highest since 2000, according to Sundial data.

It made the seasoned Wall Street pros throw up their hands, baffled with Mohd El Erian appearing on Bloomberg TV saying, “I don’t know why this has happened,” lamenting the inconsistencies between economic data and the growth story.

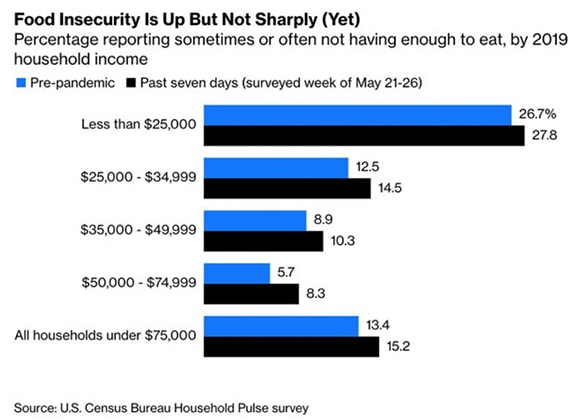

Barrons noted that “With more than 108,000 U.S. deaths from the coronavirus, the deep job losses caused by the economic shutdowns to prevent even more fatalities, and now the eruption of demonstrations across America and abroad after the killing of an unarmed black man by a white policeman, stock prices hover just under their peaks hit earlier this year”, attributing it to the widening wealth disparity, in mockery of the stark realities for the man on the street, of which only a fraction of has some level of stock market exposure.

Stark Reality = 15.2 per cent of American households making less than $75,000 a year (median household income in 2018 was $63,179) report sometimes or often not enough to eat.

Source: Bloomberg

Source: Bloomberg

Can anyone correctly identify all the programs the Fed has rolled out since March?

CPFF, PDCF, MMFLF, PMCCF, SMCCF, TALF, PPPLF, MLP

(Answer key: Commercial Paper Funding Facility, Primary Dealer Credit Facility, Money Market Mutual Fund Liquidity Facility, Primary Market Corporate Credit Facility, Secondary Market Corporate Credit Facility, Term Asset-Backed Securities Loan Facility, Paycheck Protection Program Liquidity Facility, Municipal Liquidity Facility)

Up next… The Main Street Lending Program—a $600B lending facility for companies with fewer than 15,000 employees and less than $5 billion in revenue with a minimum loan size of US$500,000 and maximum size of US$25 million.

And thus we have gone from recession to depression to recovery to euphoria in less than 100 days, which is what stock markets would have us think. But what if it was a mistake?

As the New York Times rightly pointed out, “the collapse of economic activity has set in motion problems that will play out over many months, or maybe many years,” damage has been done to millions of workers, employers, companies and their suppliers, borrowers and lenders and “historical evidence from severe economic crises and the data available today point to enormous delayed effects.”

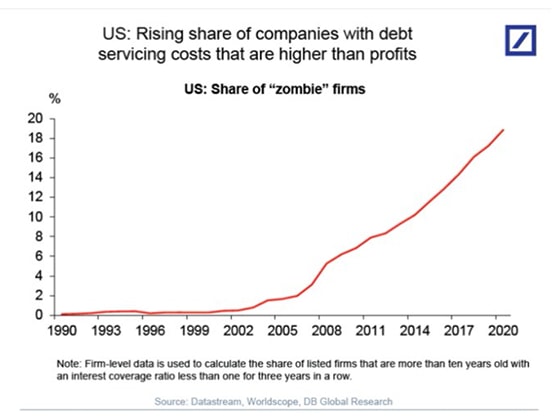

Central bankers can supply liquidity but that alone does not guarantee the long term solvency of a company as the OECD warned this week that governments cannot prop up businesses and wages indefinitely. The rise of “zombie” firms in the U.S., for companies that have debt servicing costs higher than their profits, continues to increase even as borrowing costs fall to all-time lows.

Source: Lisa Abramowicz on Twitter

Source: Lisa Abramowicz on Twitter

Perhaps it is a mistake for millionaire internet celebrity, day trader and Barstool Sports founder Dave Portnoy, to call Warren Buffet an idiot last week, as he managed to time his comment at the market ahead of this week’s correction.

Source: Marketwatch

Source: Marketwatch

With over 7 million Covid-19 cases globally and over 400 thousand deaths, some 40 million people in the U.S. unemployed, civilian protests around the world, default rates climbing in bond markets with companies filing for bankruptcies at the fastest pace since 2009, there appears to be a disconnect between financial markets and the world around them.

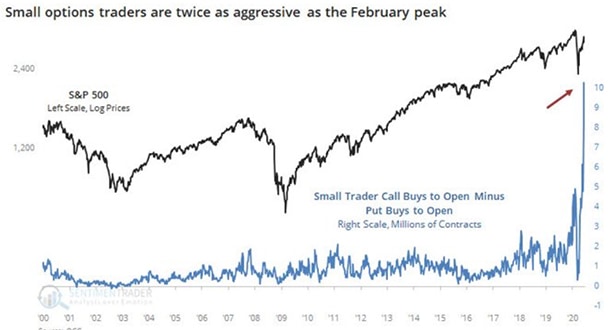

Meanwhile, retail stock option traders added to their leveraged bets with the net number of calls (long) minus puts (short) bought at twice the level of the previous peak in February.

Source: SentimenTrader on Twitter

Source: SentimenTrader on Twitter

We think there is no better time to be talking about mistakes than probably right now. And just as we think there is no Greater Fool in markets, with reference to the Greater Fool Theory, we asked an old trader friend of ours for the secret of his success this year. “Profiting from the mistakes of others,” was his reply.

Relax. This is the same friend who bought the Entertainer app at half price in March thinking it was a bargain before restaurants shuttered, and has not used it since.

Lim Chu Kang offers free scents—of manure. Make no mistake about that.