Market Thoughts: The US Fed & The Welcome Change of Tact

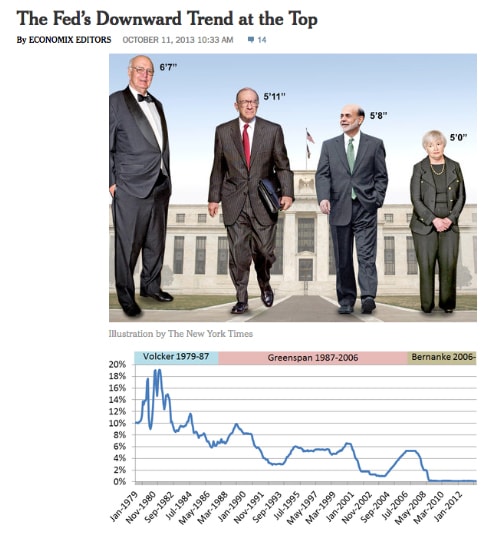

Playing to forget Drowzee (rare Pokemon) markets with volatility grinding to a halt until Fed chair Yellen spoke on Friday to give world markets direction from the Master of the Universe, all 5 feet of her.

There is only so much Singapore can do in her week of mourning for the loss of former President Nathan after a heart-stopping National Day rally speech interrupted by a fainting spell by PM Lee that coincidentally heralded the return of the haze (which is potentially bad for mosquitoes).

It was a sobering speech, much like the other 2 speeches from last year that I remember and wrote about—the “necessity of paranoia” and not-take-our-success-for-granted speech and MAS MD Ravi Menon’s speech that urge us to look past the next 10 years of uncomfortable economic restructuring and into the distant future.

The reminder that we are in for rough sort of times, much like the rest of the world and a slowdown that is quite out of our control in the near term, as long as we keep our heads up and about us, playing Pokemon Go while waiting for the next big thing which could happen to be driverless taxis (bad news for employment), riding through the volatility and mayhem (and the Zika virus which is bad for birth rates) in the months and years ahead as the US Presidential campaign goes into full swing.

The US Presidential Campaign

I would not pretend to be an expert in politics but I would not be wrong to quote Citibank in saying that it is one between 2 “unpopular candidates, with strong, yet opposing views on the direction of the US economy, and priorities in their social/political agenda”.

As I said last month, “the average Joe must be feeling most helpless and betrayed by their constitutional election process, mocked into having to choose between, as some observers put it, a “mad man” and a “liar”, whose ideals and agenda are likely to tear asunder the social fabric of the 300 odd million Americans.”

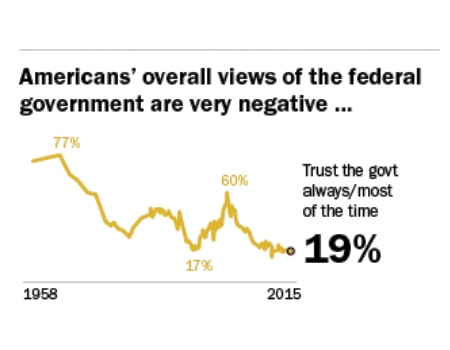

There can be no other reason for that than the, now proven, evidence that central banks have made the gap between the rich and poor wider in the developed nations and the despair that the children will have a worse time ahead.

Source: Pew Research

This has been credited for the surprise rise of Trump, as many pundits never saw it and succinctly put by the NYTimes in their headline, “How Falling Behind the Joneses Fueled the Rise of Trump”.

A Welcome Change of Tact

The feeling of dread in the marketplace has grown to unbearable proportions as far as I am concerned this month and I can lay claim to be a central bank and market watcher above average layman for these near 2 decades of the habit.

We have the BoJ expected to announce more stimulus next month, more stimulus out of the Bank of England and possibly the ECB when we have an enlightened comment from Citibank that echoes our own hearts, “what will it accomplish to say you will be more stimulative if the current level of stimulus will not work”?

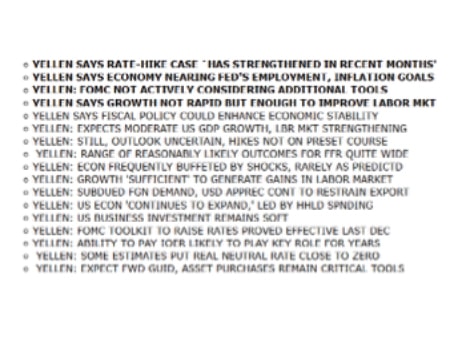

Fed chair Yellen takes charge as America the Great always does.

Source: Zerohedge

And Stanley Fischer, Vice Fed chair summed it up during an interview on CNBC if investors should be on the edge of their seats for a rate hike as soon as September and for more than one rate hike this year, Fed Vice Chairman Stanley Fischer replied: “I think what [Yellen] said today was consistent with answering yes to both your questions, but these are not things we know until we see the data.”

Hurrah! A change of tact!

The Selfish Reasons

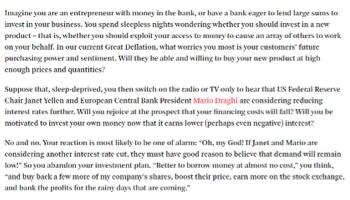

- Rates cannot stay negative forever! The psychological impact of negative rates transmutes behavioural economics which is the core of microeconomics, that which macroeconomics is intended to influence! By keeping rates low for a prolonged period reinforces a “doomsday” message to investors, encouraging the behaviours of saving and non-growth that the central bankers are trying to discourage. Yanis Varoufakis, the former FM of Greece puts it nicely in his column last week.

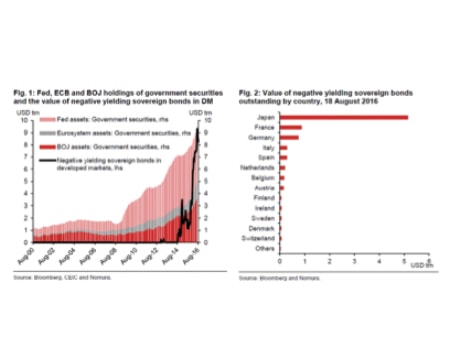

- Central banks are running out of assets to buy! With central banks owning $25 trillion of financial assets (stocks and bonds), about 10% of the global total.

Source: Nomura, The Sovereign Bond Scarcity Problem

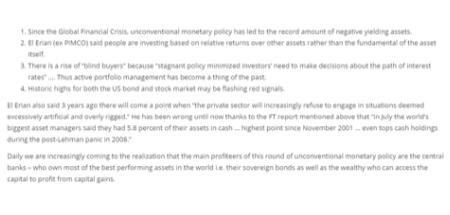

This is forcing fund managers to crowd into a shrinking pool of investments that is causing normal market relationships to break down.

As we had summarised from our Prisoner’s Dilemma Assessment of the Market.

An illustration of the trend of junk credit spreads in Europe which is showing signs of complacency and the blind belief of central bank support that BofA calls the “Keynesian Put” in the “Liquidity Supernova”.

As another result we have the current overheating in EM assets despite their flailing (“under-heated”) economies which has led to more criticism of G3 central banks and their ineffectual policies.

As ex-PIMCO El Erian put it last week, “Historically, known as a recipe for an initial upseide price overshoot followed by considerable risk of a large loss”.

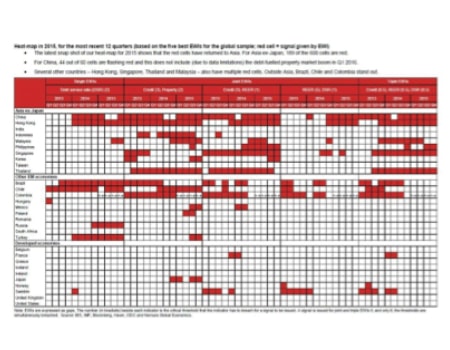

This is concurred by a recent Bank of International Settlements report on the warning signs flashing in emerging markets, and a Nomura report that Asia’s early warning indicators (of a financial crisis) are at their highest point since the 1997 Asian crisis.

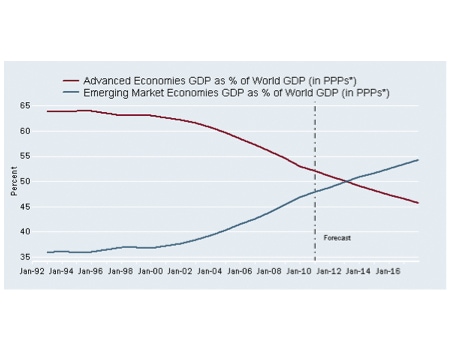

Emerging markets share of global GDP ? Very important these days…

Source: Schwab

- Divisive politics, the rise of Donald Trump and Bernie Sanders threatens the existence of the Fed which is bearing a lot of heavy criticisms from academics and professionals who all qualify to be their replacements! And the in-thing now, with the new US President, would be the new theme of fiscal spending that has been proposed as the cure for secular stagnation.

Think, A Fed Hike Is A Cut Everywhere Else!

Yes. The Fed has changed their tact and all is not lost if the US economy is deemed fit to withstand a rate hike or two, notwithstanding the skeptics who protest that the economy is too fragile for higher interest rates.

Yes, because any investor poll will return the answer that rates are too low in the developed world and negative rates do more harm than good. So it does not matter what the minority camp says.

The ball is back in the courts of the Bank of Japan, the European Central Bank and the Bank of England who will welcome the breathing space as the impending US hike does the rate cut for them, giving them time to reflect on “what will it accomplish to say you will be more stimulative if the current level of stimulus will not work”?

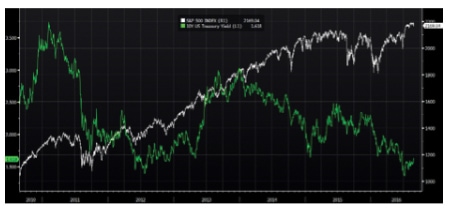

My stance was to stay asset light into the US Presidential’s and to cash out on the Jaws of Death chart pattern that we saw in the S&P 500 against the 10Y US treasury bond.

The chart looks like this today.

I would still advocate staying away from assets that are majorly influenced by interest rates, directly or indirectly, for the healthy correction that will be coming its way, given that the possibility of a volatile sell off is diminished on the fact that the central banks are holding to the high risk negative yielding debt.

While it is prudent to realise that we will be going into every economic data release from now till the next FOMC like religious zealots, I personally do not think a 0.1% miss in in GDP or 25,000 difference in the next US non-farm payrolls, for instance, versus market expectations will be a deal breaker.

It is harder to worry about what data would it take for them not to hike than the data would make them hike.

Yet with fiscal policies that take a longer time to deliver, as Singapore plans ahead for the next decade with fintech initiatives, driverless cars and aerospace travel, spending that does not translate to immediate profits, we do need healthy economic optimism that comes from a change of tact.