Market Thoughts: What’s Going On?

There is something about the week leading to Easter—starting with a stuck ship on the Suez to a hedge fund that blows up, a train wreck in Taiwan to explosive employment growth data point in the U.S. for the stock market to close at a new record. This reminds us of the new “carpe diem” driving trend on the roads these days, drifting slightly into the next lane and stepping on it in blind faith.

Since the advent of the sharing economy, drivers simply dart out from the side roads, make Initial D-like U-turns and dash for that light or lane much like the YOLO markets that have evolved.

1Q21 has not been a kind quarter as anyone without a diversified portfolio proper would like to believe for all the post-pandemic sentiments and the emergence of a strong recovery in trade and finance as businesses reopen. There is nothing but demand, demand and more demand everywhere.

Stocks are at their all-time highs, housing prices at their all-time highs, Crypto (Bitcoin/Ethereum) close to their all-time highs, inflation expectations at the highest since 2008 and the US central bank re-asserting that they need 0 per cent rates through at least the end of 2023 with trillions more in bond buying to do.

Three major financial scandals since January—Melvin Capital, Greensill Capital and Archegos Capital. Billions of dollars of damages and the cavalier market spirit sustains.

What’s going on?

Yes, the year has been fabulous if your entire portfolio was in Bitcoin because we are hearing of people under 30 opening private banking accounts (minimum US$5 million) and declaring Bitcoin as the main source of their wealth. Bitcoin price. Bitcoin was just $10,200 six months ago, $18,300 three months ago, $44,700 a month ago and now close to $60,000. Imagine the amount of wealth created there?

On the other hand, we have bond trader friends all facing severe burnouts in perhaps the worst quarter on record for the 30-year US Treasury bond which suffered at a 16 per cent loss. The total return of the broader Bloomberg Aggregate Index was a 3.37 per cent loss in the first three months of the year, its worst quarterly return since the 1970s. And by all accounts, there will be more pain ahead for bond markets.

10 year yields end Jan 1.07%, S&P 3699, 1.40% end Feb, S&P 3807 and 1.74% end Mar, S&P 4,000.

Perhaps the icing on the cake is that junk bonds are thriving, escaping virtually unscathed, buoyed by the strong equity markets.

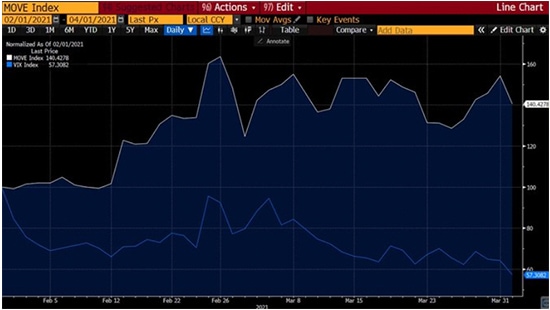

In the past two months, the MOVE (bond volatility) has increased by 40 per cent and the VIX (volatility of stocks) has fallen 43 per cent.

Source: Bloomberg

Source: Bloomberg

Something is amiss. Bonds do not get smoked without collateral damage to other asset classes.

What’s going on?

“Maybe the dopamine hit from trading in stocks has become a substitute for sex?” — Albert Edwards, Soc Gen

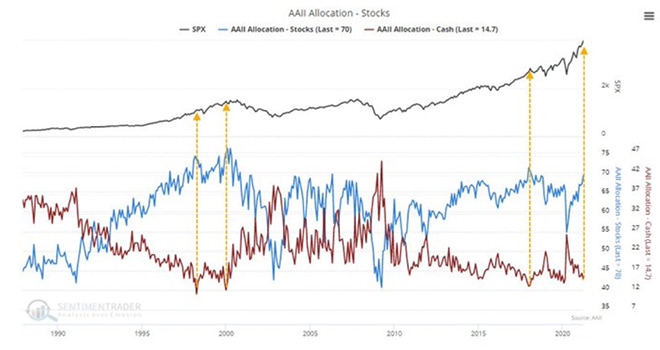

Speak to any private banker or advisor and the rhetoric is all-in for stock allocations with Mom’s and Pop’s all in, judging by the U.S. stock allocation metrics with stock allocations at extremes and cash allocations at lows.

Source: SentimenTrader on Twitter

Source: SentimenTrader on Twitter

Yet if we delve into the seemingly innocuous stock index at its all-time highs, we would see a truly ugly picture of what some will describe as the most brutal rotation ever in the past decade with the most improbable gains and losses that are more than meets the eye. And Gamestop’s Roaring Kitty is still up 1,100 per cent after three months as Deliveroo shares plunge 30 per cent on its first trading day in London.

Apple, Microsoft, Amazon, Facebook and Alphabet contributed 43.8 per cent of the S&P 500’s rise from 3,000 to 4,000 and the S&P made a new all-time high on a day where only 3 per cent of 500 companies are at their 52-week high. Stocks in the Russell 2000 are down an average of 22.3 per cent from their 52-week highs, and nearly 200 are down over 50 per cent.

How is that for a fact?

% Below 52-Week High (courtesy of Compound Capital Advisors)

S&P 500: 0%

Nasdaq 100: -6%

Amazon: -14%

Apple: -16%

PayPal: -22%

Twitter: -24%

Square: -25%

Salesforce: -27%

Shopify: -29%

Twilio: -30%

Tesla: -31%

Spotify: -33%

Peloton: -38%

Zillow: -38%

Snowflake: -46%

Zoom: -46%

DoorDash: -48%

Virgin Galactic: -53%

What is going on? We do not know.

“This isn’t a bull market or a bear market. It’s a know-nothing market… Bragging rights used to go to those investors who worked the hardest at learning the most. Now the glory often goes to those who know the least and don’t even care.”— Jason Zweig, WSJ

‘Hot stocks have zero earnings (think Tesla); hotter stocks have zero revenues (think space-exploration companies and electric-vehicle startups being snapped up by SPACs). So negative revenue ought to be even more appealing, right?’ — WSJ

If we have to dissect it, it is the competing narratives between Valuation, Inflation/Stimulus/Growth, Liquidity and the moral hazard of central banks driving Animal Spirits.

Valuations

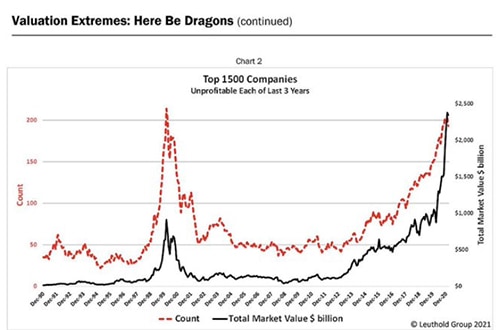

Without even going into PE ratios or Buffet’s golden market cap to GDP ratio, how about just common sense? “Investors are pouring money into unprofitable companies more than any time since the dot-com bubble,” according to a recent report by Scott Opsal, director of research at The Leuthold Group.

Source: Money.com

Source: Money.com

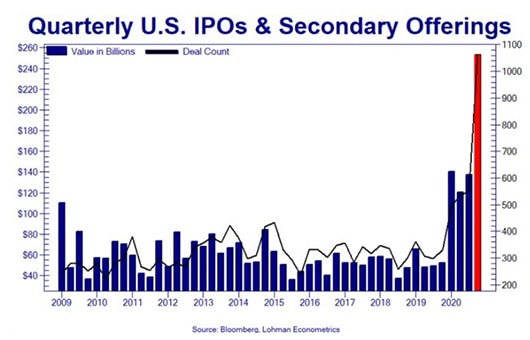

IPOs and secondary offerings are all absorbed with ease so far even as PIMCO is calling it a bubble on fundamentals.

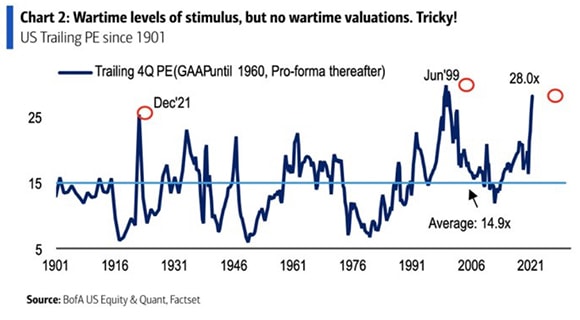

Just to put things into perspective: Q2 kicks off with 2nd highest PE since 1901. Wartime levels of stimulus, but no wartime valuations, BofA says.

Inflation/Stimulus/ Growth

Central banks keep claiming inflation is temporary.

Source: Hedgeye

Source: Hedgeye

As Albert Edwards says, the word for it is ‘ipsedixitism’: the dogmatic assertion that something is ‘fact’ without any proof to back it up, or because someone, somewhere said it. The word describes perfectly the Fed’s repeated assertion that their QE has ‘helped’ the economy—as opposed to creating zombie companies, blowing grotesque asset bubbles and fostering populism.

Toilet paper prices are climbing, commodities are flying, semiconductor chip prices will be raised in April, freight routes, minimum wage and all will be contributing to inflation which is evidenced in the U.S. inflation expectations indicator, the 5y US bond breakeven. In Singapore, we have electricity tariffs going up from April to June.

And it is not just inflation. It is now hyperinflation that is worrying people enough to drive home prices up to records around the world. In the U.S., where house prices rose more than 11 per cent in January, record number of homes are selling above their asking prices and a $400,000 home got 122 offers in two days; in Australia where house prices are rising faster than any time in the past 30 years.

Just take a look at the best-performing stocks in Singapore for the month, they are none other than companies with sizeable real estate holdings that are undervalued, price to book terms.

Why the hyperinflation story?

Just look what happened to Michael Burry of The Big Short fame, who stopped tweeting earlier in March and deleted his tweets after the U.S. SEC paid him a visit after his stream of rants on the potential of hyperinflation (including criticism of Tesla, Bitcoin and Robinhood), leaving 400,000 followers in the lurch.

We had a US$1.9 trillion package and another proposed $2.25 trillion economic plan, plus another $2.2 trillion from the ECB and God knows what from the BoJ, the pace of growth for 2021 is set to be the fastest in 40 years for the U.S.

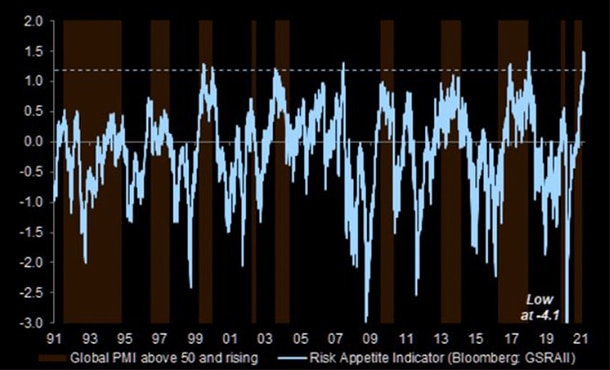

As it stands, U.S. manufacturing has surged the most since 1983 so far in 2021 and global purchasing managers have never been so optimistic as U.S. consumers who plan to buy car/trucks are the highest since July 2020, major appliances, too, since February 20. The plan to buy a home is also the highest in the history of the consumer confidence survey.

Source: Bloomberg

Source: Bloomberg

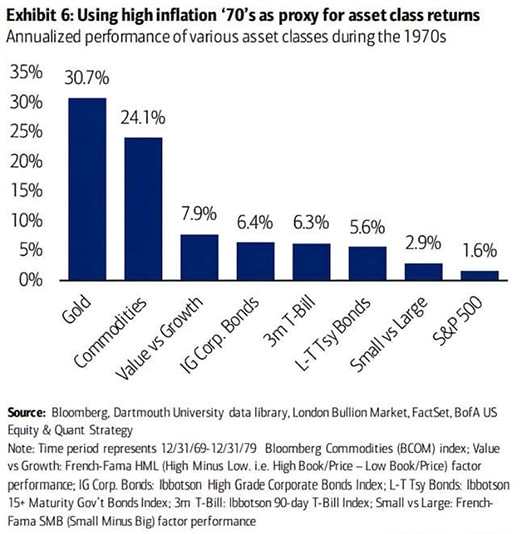

While these are early days and we do not know what will really happen, if the idea of high inflation or hyperinflation will transpire, then the stock market is probably the least big beneficiary if we use the 1970s as a proxy.

Source: BofA

Source: BofA

We are clearly not anywhere near hyperinflation yet because Joe Weisenthal of Bloomberg just discovered the mental disorder of Zero/Cipher Stroke on Twitter, which is a disorder primarily characterised by the desire of patients to write endless rows of zeroes during the hyperinflationary period of the Weimar Republic.

The counterpoint would be faith. Faith in the system and that central banks will know when to close the spigot in due time but we do not have any evidence, factual or anecdotal, to show for that.

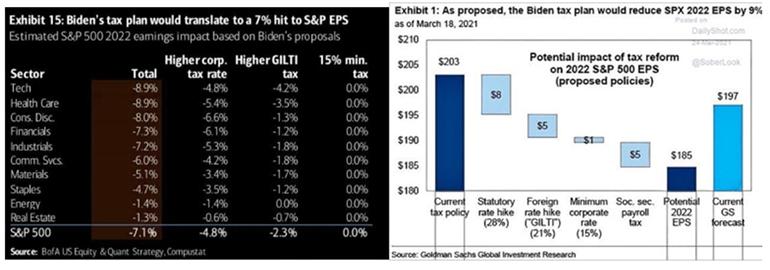

And what about the Biden tax plan that would shave off 7 per cent of the S&P’s EPS according to BofA, or 9 per cent according to Goldman?

Liquidity and Animal Spirits

The best narrative for a story would be the liquidity story.

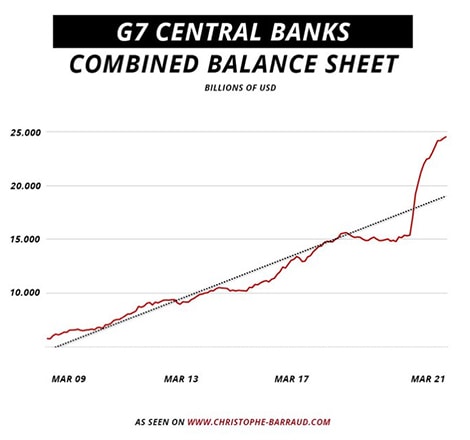

The G7 central banks combined balance sheet has grown by more than US$9 trillion since February 2020. There is not a single or combined private entity(ies) on Earth to challenge that unless we have a collective rebellion of the human spirit and belief system.

This has translated into all the excess leverage in the system that can bear the blame for perpetuating the likes of Melvin Capital, Grensill Capital and, of course, the 21st century version of LTCM, Archegos Capital, in addition to the Robinhood’s (retail leverage), SPAC’s, NFT’s, altcoins and alt-investments that are rising in demand from insane to inane levels of animal spirits.

What’s going on? We really do not know.

Our best guess is that markets are still figuring it out, but the situation is getting unsustainable. We will continue to have those “paint whatever narrative you feel like seeing on to it” kind of trading days, to quote Guy LeBas. As a consolation, hedge funds (the smart guys) have been getting it all wrong as well, for all the thinking they do, “burned on Longs AND Shorts, a double blow *L-S spread, a measure of alpha, down almost 11% this year,” and heading for the worst year since at least 2015.

These are the crazy days where risk-reward looks too risky or unrewarding unless bold calls are made. It would be irresponsible not to highlight all the other stuff we omitted to talk about that would make an investor shudder for all the risks in antitrust, crypto regulations, geopolitics, more scandals to come in ESG or finance and much more.

As for us, we still think 2021 is BS, not bull but ox, but it’s still early days and we get a dreadful premonition every time we keep asking, “What’s going on?”