Reflections on Mad March Hares On The Ides Of March & Getting Rich In Singapore

It would be an absolute Shakespearean tragedy for any financial post written this weekend not to mention anything about the FOMC rate hike that was interpreted as a cut for the first time the FOMC statement that fell on the Ides of March which we were mostly too busy to remember, and any self-respecting writer would be hard pressed not to say anything about it. We have had posts ranging from how the Federal Reserve scored a coup d’état, engineering the markets exactly where they wanted, to allegations that the market has the central banks on a noose which justifies the rally in almost every conceivable asset class after a rate hike!

We can be almost sure anything article you read urging you to buying anything, be it Gold or stocks or high yield bonds or EM currencies for carry, till the cows come home or the fat lady sings (tho’ I would disagree that Janet Yellen is fat) must be written out of sheer frustration or rage with the Fed.

As such, this writer has nothing terribly clever to say but for a funny observation overheard that 60% or more of market participants, or people running the show, have never worked in an environment with the Fed Funds rate above 1% and could be excused for their immediate reactions. For are we not shaped by our experiences?

That is so much I have to say for the markets, the Fed and the G20 finance ministers meeting this weekend which spells bad news for trading nations like Singapore with the roll back on the commitment to global free trade.

Excuse Me For Connecting the Dots

What about the good news this week with Singapore exports growing at their strongest pace in 5 years?

And the bad news this week as Singapore resident jobless rate rises to 3% with job vacancies down to the worst ratio since 2009.

And jobless graduates highest since 2004?

On a closer look at the article on the Asiaone website, I would think if you are 50 and a former middle manager who has lost your job, your driver’s licence is worth more than your Bachelor’s degree!

Think about it, folks. Think about the latest person you know who has lost his livelihood, and think about the latest friend you may know, driving for Uber or Grab, who loves his work freedom and free mode of transport that is, without doubt, the reason behind the worsening peak hour traffic.

Yet, thank goodness for the boom in the ride sharing industry or the unemployment rate could be much worse.

Think about it, folks, when you read that retail sales in January rose thanks to the strong increase in F&B and supermarket sales.

Then think about it when you read about that Motorcycle COE prices hit new high and think about how the food delivery business is obviously benefiting the restaurants.

Let’s Think About It

If we wait for the day that “your driver’s licence is worth more than your Bachelor’s degree!” piece to come out on mainstream news, we will understand why journalism is on the decline globally, why The New Paper is free now while lucky Malaysians have Raja Bomoh and high and low profile assassinations to keep their tabloids well stocked.

No. This post is not about blasting journalism, fake news or Singapore’s economic problems because it is not my place to boost the sales of all those smart parents seminars and conferences for over-eager parents to jam up those coding classes for the new meal ticket of the future. And also, that was what they said about that bachelor’s degree 20 years ago.

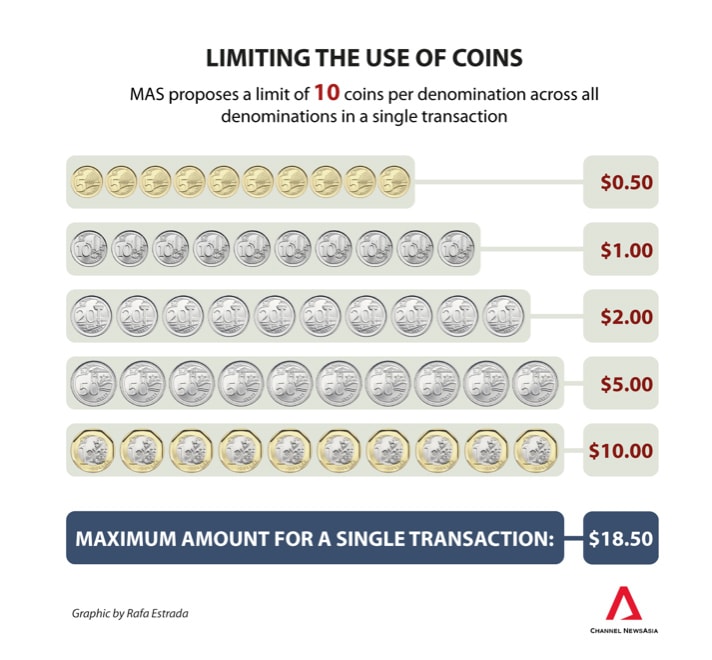

This post could be about the fastest way to get rich for I feel poorer for every 5 cent coin I own right now, because shops are starting to refuse them now (so much for legal tender) that the MAS is proposing to limit the use of coins for payment.

Think about it, folks. It is not in sympathy for the used car dealer or the Sim Lim chap. It is the start of demonetisation because we are seeing mixed response to cashless payment options at hawker centres.

I am not one against the demonetisation movement and I well intend to install ApplePay soon although I do feel there is money to be made from phone insurance including back-up plans for failing Wifi or out of service scenarios and we did have some internet outages last year which means errr, no payment allowed and of course, we even had that Tesla driver who could not start his car because his phone had no wifi which was his own fault for driving in a desert.

And of course, the hackers are only targeting to steal from central banks at the moment and not our paltry bank accounts.

I am not too worried at all but it does mean if I do not have a credit card because I do not have a job, life will get a bit harder but the bright side is that there will be a career to consider in the hack-defence industry for those wages are going to get heated up, getting the right talent for the job.

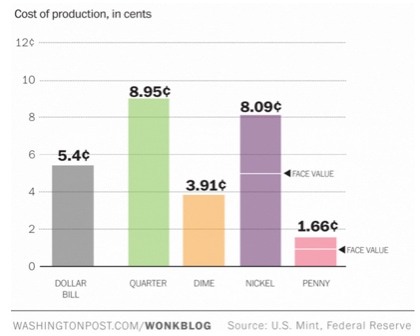

Ultimately, we are not going to miss those 5 cents too much because the 1 cent came and went and no one is fussed about it, least of all the Singapore Mint, where it cost more to mint a 1 cent coin than its face value, which is a common problem for central banks around the world, judging from the illustration below.

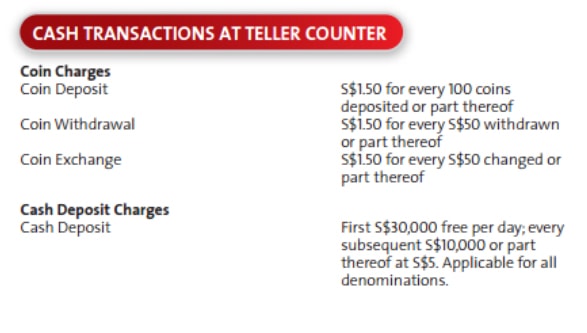

Not to mention those nasty deposit fees that banks are charging for coins now.

Getting Rich In Singapore

It’s been a busy week for the MAS and the public, first coming out to warn investors on the risks of trading binary options on unregulated platforms, because binary options can make you rich but you may not be able to claim your windfall.

The odds of a binary option is about 50% which makes them decent bets as opposed to buying the lottery, where the odds are way poorer even if we are assured that our bets are donations to charity. But something about that Peter Lim ad that pops up all over the web or those gold plated Bentleys should say something about the product especially when you have no idea if you are getting a good price.

Before you trade a binary option, please know how to price it. And a few friends and I got the moment of truth speaking to some investors we met. We found that expectations appear inversely correlated to quantum.

That is, the investor with $5k to spare expects $5k (100%) in return in 3 months but someone with $25k, for instance, would expect $5k for the same period. There is an unexplainable urgency if you have less funds for investment.

The irony is that leveraged forex would be the best bet for anyone seeking to double their fortune which is what I had initially set out to talk about today before perhaps letting the Fed frustration get the better of me.

We shall save that for Part 2 next week.