SGD April Monetary Policy Statement: April Is No Fool

Another week and we ask ourselves do we know a happy banker? Not me. Every banker I have been speaking to is unhappy about the state of the economy and markets and I cannot squeeze, for the life of me, a single iota of optimism out of them until I seek out the fintech folks who are all aglow with enthusiasm.

To that end, it is no wonder we have been reading nothing but misery in those economic reports that started after the crisis and 8 years on, the urgency for another crisis has built up into a crescendo as markets find a new punching bag in Donald Trump.

Ask ourselves, has the haters camp grown because bonuses have been shrinking and layoffs have been increasing? Bankers now realise that fat pay-cheques are now a thing of the past while new market entrants see that the fat pay-cheque is nothing more than a pipe dream they were promised when they were in school.

With flashy sports cars now replaced by good old family sedans, and is it a wonder now everyone is feeling dour, hating every single minute of this Trump rally, as Christine Otterwood summed up in her final newsletter below.

You just cannot help but get the feeling that the media (who hates Trump) and economists cannot wait for the self-vindicating correction and their voices are growing louder as each day passes, cascading to a point where a 1% drop in the S&P 500 last week elicited such dramatic calls for the end of the world (even if the S&P 500 is up 14% since the US elections), leading 10Y US treasury prices to rise 2%.

12 Month Chart of the S&P 500

Imagine if 10Y bond prices rise 2% for every 1% drop in the Dow, going forward?

End of bash.

April Is Nobody’s Fool in Singapore

April is the cruel month and it is no fool’s game, one year into the death of the artist formerly known as Prince, the world is a vastly different place from April 2016, confronted with Brexit and the improbability of a rather unpopular US President, Donald Trump.

We just cannot help but pity those central banks with policy meetings 8 times a year like the FOMC, BoJ and the ECB, or the Reserve bank of Australia at 11 times a year! And congratulate Singapore’s MAS for their foresight in anticipating the need for only 2 policy meetings a year.

For the one that is coming in the next fortnight, some time between the 7th to the 14th of April, we have the market expecting some answers after the pain inflicted by the last monetary policy statement in Oct 2016, even though surveys all point to a near unanimous 100% expectation that there will be no change.

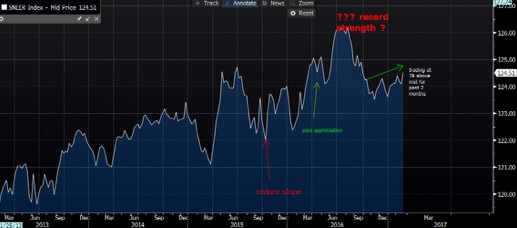

After April 2016’s abrupt change to a zero appreciation stance, the market chose a contrarian approach to drive the SGD NEER to a new record high within 3 months in July before crashing into October’s zero appreciation stance again. (Possibly because they were fortune-telling and divining a policy reversal for October until Brexit hit?)

5 year Chart of the SGD Neer Index

And so the pain for the folks who had relied on MAS’s October statement that the rate of appreciation would be zero percent within an estimated range of +1/-1% from the mid-point and we have had the SGD dollar trading on the strong side for the past 6 weeks, forcing many a trader out of their short SGD position, as the questions mount, as to whether the MAS will be changing their minds sooner than later about that “extended period” of neutral stance.

This is because, unlike major central banks and some regional central banks, our central bank does not talk a lot about monetary policy and interest rates even with the revolution in the world of central banking and the commitment to transparency with some level of forward guidance to reduce volatility in expectations and violent market moves.

To Fully Appreciate Singapore

To fully appreciate the USDSGD and the good it has done for people, we have to look at this chart which depicts the relationship between 3M SIBOR and 3M Libor and that Libor overtook SIBOR right after the October 2016 MAS monetary policy statement and has widened the gap to a multi-year high of 0.21% last week, not seen since 2008.

MAS was only paying lip service when they said Singapore rates should take cues from rising US rates in February because interest rates proceeded to crash lower despite the US, as evidenced in the chart above. And we cannot imagine the backlash the authorities would face if rates really took the cue from the US, when the headlines have been all about the unemployment situation? Surely we cannot have news articles on the unemployed facing higher mortgage rates?

It is a good thing that we have all this strengthening of the SGD against the NEER that is keeping rates low.

What Will The MAS Do For A Happy Ending?

With global central banks all on hold, China stands out as the only proactive country, tightening certain lending rates this year. Thus the unanimous consensus that the MAS will stand pat because they cannot be seen backing down on their “extended period” stance after 1 meeting, given the uncertainty of the economy and on the unemployment front.

Yet, keeping the market on tenterhooks is not a bad strategy to keep those interest rates low enough for the public not to complain or feel the pinch and thus, they may remove that “extended” word, leaving the door for an October policy change open. At the same time, financial conditions will remain over-easy and accommodative for bonds.

The negative funding of the SGD against the short USD (for US rates are now higher than SG) will eventually bite into the parties short the USDSGD, especially if more US rate hikes are priced in.

This gives the SGD some room to adjust back lower from its overvalued levels against the rest of the basket of currencies (until we come closer to October).

Sounds like a happy ending?