Sugar Highs to Beat the Inflation Blues

Yesterday marked the change in season with the Vernal (Spring) Equinox and spring cleaning begins with fervor for some of us.

Cleaning out the pantry can be full of nasty and pleasant surprises especially when you come across a veritable collection of sugar sachets that dates back over 20 years, just like that postcard advertisement fad that has come and gone. It had initially started as a cheap souvenir substitute of a particular fond memory of a coffee shop or a funky pack of sugar as the extra touch of a proud café manager.

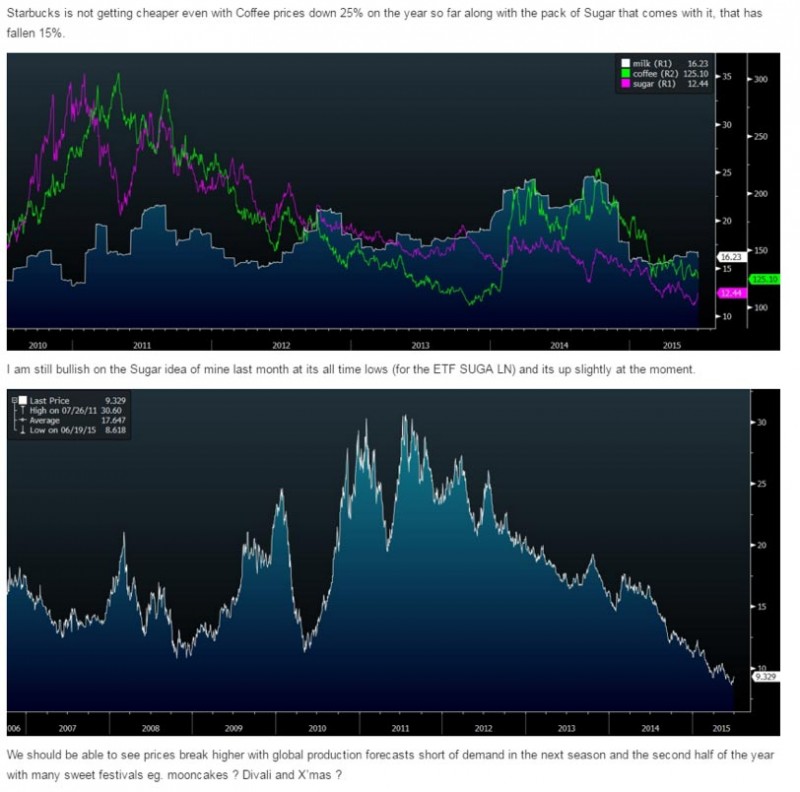

In later years, the sugar sachets started piling up when you did those commodity trades, grabbing those Starbucks sachets in symbolic solidarity with your longs as Jim Rogers jokes about in his seminars too, coincidentally.

Sugar is one of the 10 foods that does not spoil, along with whisky, my other favourite food stuff that does not go bad. And sugar has been the best performing soft commodity in the past month, rising 25% against the USD to a new 1 year high of $16.10.

The sugar collection crusade has done well for the past 12 months, through higher lows and higher lows and thankfully for the El Nino, that the “Silent Killer” commodity has turned out to be the best performer in the world.

And Sugar is not exactly the same “sugar” in the respiratory processes of all things living.

Nonetheless, the rewards have been good for our Sugar call in July last year, although we cannot say the same for the AIGA LN (Agriculture) ETF which we have favoured a little over Olive Oil.

Source: Tradehaven

Inflation

How convenient it would be for the global central banks if Sugar was all that was needed for inflationary pressures.

25% in 12 months!

Alas, Sugar is not Oil which has its foot in every piece of the pie in terms of contagion effects, stretching from agriculture (fertiliser) to industrial and to the R&D investment dollar, all closely tied to the financial system, global markets and even politics.

With central bankers all bent on an inflationary path, all the way to bringing interest rates into negative territory, markets’ first reaction has been one of rejection and we note the big snubs to the BoJ and the ECB on their recent decisions as the markets took their currencies stronger, adding to financial stress in the system, adding to confusion and spreading the mayhem especially after the US Federal Reserve revised their rate hike expectations last week where we got a reaction quite akin to the last QE3 announcement, further weakening the USD and undoing the BoJ’s and ECB’s efforts to date.

Preparedness

The time is nigh, surely, to believe in inflation again and to take up that cause that it would be the main event the markets would be unprepared (or rather, unpositioned) for in the months and weeks ahead. Because over 7 billion people still need to eat daily and prices as much a function of demand and supply as it is a currency story.

From the chart above, we see the US dollar has an inverse relation with the AIGA LN stock price, suggesting that agricultural prices are heavily influenced by the US dollar.

Commodity producers are bearing the brunt of the heat these days from Indian cotton farmer suicides, dying for the lack of inflation, to energy producers filing for bankruptcy, sordidly benefiting commodity prices.

The Weather And Geopolitics

2015 has gone down as the hottest year on record and to make it worse, February 2016 has been the hottest month in recorded history, surpassing the, now, second hottest month which was December 2015, a bad sign for sugar beets (main source of sugar in the cooler climates)!

Temperature fluctuations are not good for crops to say the least for floods and droughts.

Throw into the equation, rising tensions in the Middle East, terrorists running amok in much of oil producing Africa, oil prices are sitting on tenuous levels even if demand is falling to cause suppliers to go out of business.

Negative Interest Rates And the Bang For the Inflation Buck

What should give every commodity investor a degree of comfort is that commodities, as an asset class, have not benefited from the zero–turned-negative rates policies around the world. Even zero-yielding gold should give an investor some comfort over negative yielding bonds and real estate bubbles. Perhaps it is just that investors have not got their heads around that idea yet and even if they did, some of their investment mandates do not permit them to execute such a plan given they are not managing their own money.

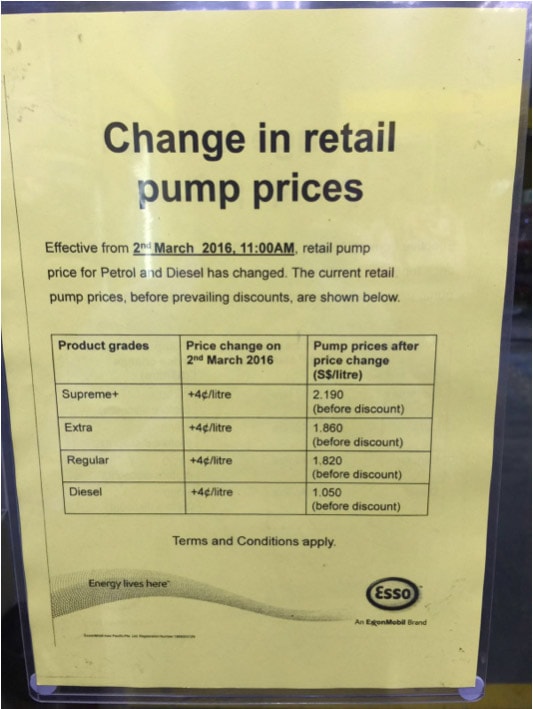

The bang for the inflation buck really comes from wages which could be the reason why Esso stations decided to hike prices in March and why BreadTalk is is charging SG$2.30 for coffee while issuing bonds at low yields.

As for the low cost third world commodity producers, the set back from lower prices will mount as wage costs will increase. The eventual rise of wages will have to be made up in the form of higher prices which is an inevitability for low cost labour. Afterall, the painful truth for us sitting in our comfortable offices is that we really need every African to buy an iPhone to turn the global economy around, given the Chinese contributions to iPhone and real estate demand.

Why Now?

The Bloomberg Agriculture Total Return Index above says its all.

Timing is the key and prices are near their 10 year lows as global commodity indices which include Oil, are at their 15 year lows in a beautiful downtrend. Perhaps it is time to cut the central bankers some slack for their desperation and make some money out of negative rates instead of sticking to low yielding bonds and bubbly real estate? And get a high from beating the inflation blues.