The Lowdown on the Latest Crypto Trend: NFTs

Two months ago, Grimes made US$6 million in just 20 minutes. This came from a collection of ten videos that were auctioned on Nifty Gateway. The highest-selling video called “Death of the Old” featuring flying cherubs went for a whopping US$389,000. If you are confused as to what is happening, you are late to the party.

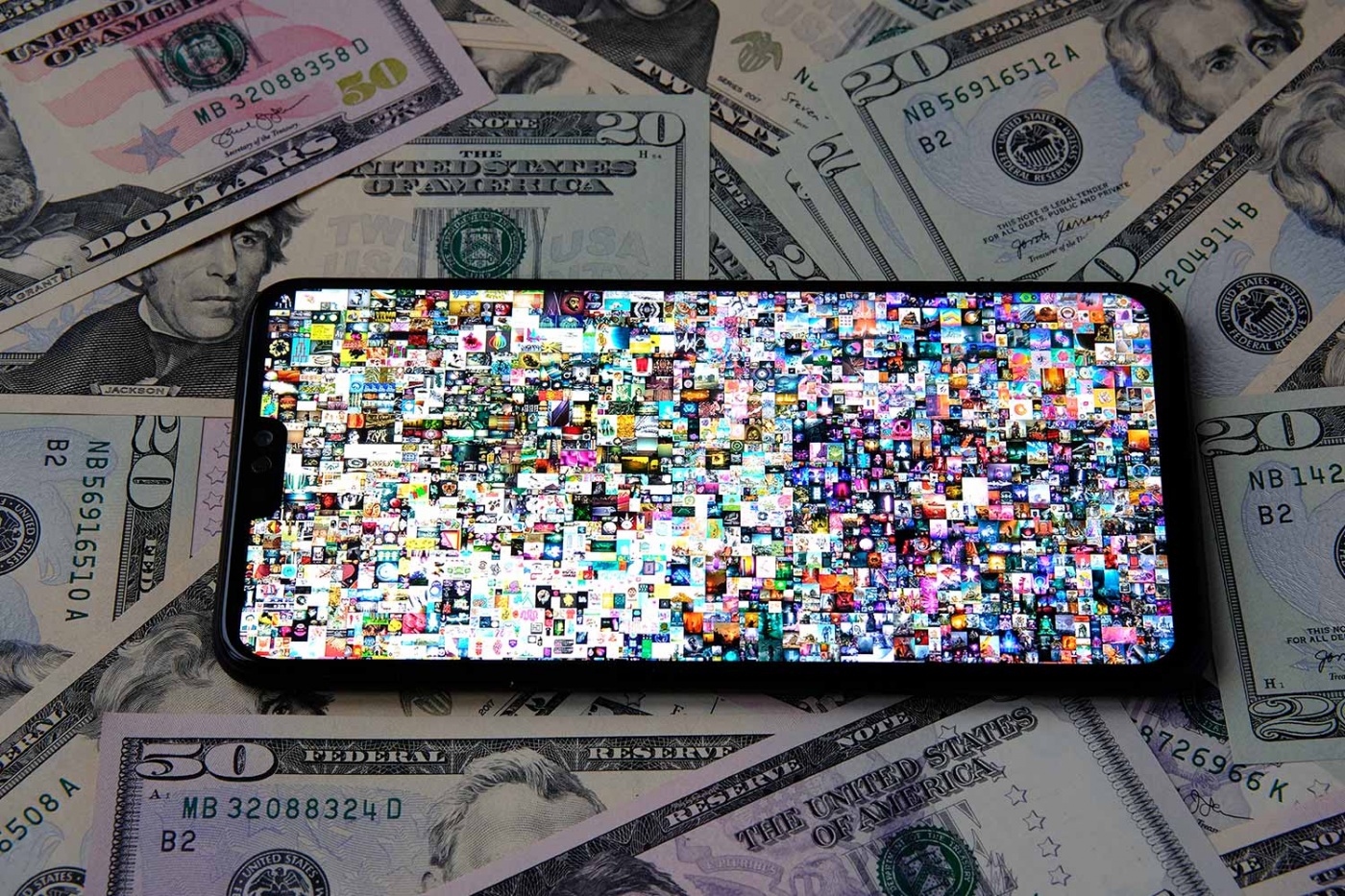

Recently, the cryptocurrency world has been buzzing with discussions about these unique one-of-a-kind virtual tokens that can represent almost anything from digital art to sports mementoes. And people have been shelling out a huge fortune (from hundreds of thousands of dollars) for these non-fungible tokens (NFTs). In March, the digital artist Beeple auctioned off an NFT of his work for US$69 million at Christie’s, making him “among the top three most valuable living artists.” While NBA Top Shot, a website dedicated to virtual basketball trading cards has amassed US$215 million by selling its digital Moments in five-card packs and is currently developing a digital collectibles game based on the UFC mixed martial arts league.

So what are NFTs?

The craze for NFTs first started in 2017 when Dapper Labs’ game CryptoKitties witnessed 95 per cent of Ethereum network usage. Since then, the market for NFTs has climbed to US$338 million in value from around US$41 million in 2018.

For the uninitiated, NFTs are the current vogue for the buying and selling of anything digital. Apart from art and sports, NFTs can be used in virtual real estate and gaming. They are non-fungible tokens that run on a blockchain network and can be stored in digital wallets as collectables. Since each NFT accrues value independently, they cannot be replicated or exchanged for another. The more scarce the NFTs, the greater their value.

How they work

An NFT provides you with a digital signature in the same way as a physical painting. For sellers, NFTs open up the possibility of selling something in the present that may continue to help them earn in future. This will benefit artists, who often have had to fight for compensation if their work appreciates in value over time. These tokens can be coded to allow the original creator to get a cut (up to 10 per cent of the sale price) each time it changes ownership, helping them gain a steady stream of revenue. Many artists like London-based Robert Alice believe that these tokens are the largest reorientation of power and control back into the hands of the artist since the Renaissance.

The risks associated with NFTs

Some may regard NFTs as a panacea for artists and musicians, but with everything new, it’s always better to be on the qui vive. Investing in such alternative markets presents more risk than bonds or equities because they are unpredictable. Your purchases may not increase in value the way you expect them to, nor will they maintain a stable value. As the market is still fairly speculative, erratic price fluctuations can be expected. Its crypto cousin Bitcoin is currently worth almost US$50,000, which was a huge jump from a year ago where it was only worth a fifth of that.

Hype or not?

Many are intrigued by how NTFs have become an accessible (and creative) aspect of crypto. As famous brands start to cash in on the craze, more people will follow suit. Many sites like Showtime are combining NFTs to offer an Instagram-like experience, and NFT marketplace Catalog has its digital record store underway. Unlike bitcoin, people can do more complex and exciting things with NFTs like setting their own terms.

In the music space, many reckon that NFTs are a trend that will explode. President of music and tech investment firm Raised In Space Shara Senderoff thinks that this is due to the “ability for a fan to purchase an asset that is scarce, that is limited, that is exclusive, and has potential offerings tied to that that make them as a loyal fan feel unique, feel rewarded.” On the same note, Caty Tedman, head of partnerships at Dapper Labs says that NFTs are here to stay.

With NFTs, you can create unique brand experiences

With all the global fascination surrounding NFTs, they have opened up new avenues for businesses to interact with their audience, while increasing conversions and revenue. Many notable brands like Taco Bell are using NFTs to create brand awareness. The fast-food company sold taco-themed NFT GIFs to support the Live Más Scholarship. All it took was 30 minutes for all their NFTacoBells to be snapped up on the marketplace Rarible. While each GIF started at a bidding price of US$1, they spiked in value and have been resold for a few thousand. This helped the company generate major attention on both social and mainstream media.

Just a decade ago, the Nyan Cat GIF created waves when creator Chris Torres made an NFT version of the GIF that sold for over US$500,000 on the crypto auction site, Foundation. He went on to organise an auction where classic memes were sold as NFTs and the highest-selling meme Bad Luck Brian went for US$34,000. Lesson learnt? Customers will pay for great experiences. Consider converting your best ads into NFTs or create an auction to sell them off. Not only will this boost awareness for your brand, but it will help you attract a new legion of followers in the tech arena.