The Thin Red Line of Foreign Exchange Rigging

The first thing that strikes anyone visiting a dealing room for the first time back in the old days was the noise from the intercoms between desks and broker boxes blasting endless streams of prices. For those who could not wait for the intercom, they would yell across the room for attention.

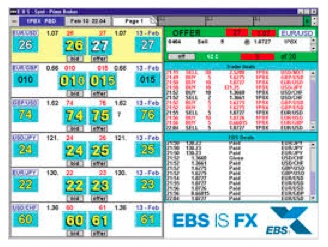

When one gets used to the noise, for it was mostly noise unless it mattered to you, one would realise that most of the activity came from the forex (FX) trading desk – the loudest and most colourful of the desks with their flashing EBS screens updating prices by the seconds.

Picture of a typical EBS screen

FX traders are an entirely different breed and have always struck me with a little awe, sitting there in rapt attention to the flickering screens and ears shut to the world but for the “noise” that mattered to them. Reacting like automated machines buying and selling, managing their constantly changing positions that result from client flows and their trades.

I have always worked with the FX desks throughout my career, starting out on the FX forwards, a derivative of FX and short term interest rates (up to 12 months), and in my bonds and interest rate derivatives days, I was trading FX within my proprietary trading limits, using FX as a hedge or in pricing currency swaps and so on.

All I can say is that the seemingly easiest product is the hardest to trade. With minimal math involved, you can go by anything from economic data releases to infinite charting and graphical possibilities to even astrology that some swear by.

Trillions exchanging hands daily with the numbers growing as daily turnover increased to $5.3 trillion USD a day in 2013 from $4 trillion in 2010. The USD remains the unchallenged currency of the world with 87% market share daily, referring to the Bank of International Settlements Triennial Survey.

It has been estimated that 99% of daily turnover is the result of speculative activity which means that the FX market is the undisputed casino of the world.

Why?

Because FX is a zero sum game. FX is not an asset. It is just the relative value of one currency against another. When one executes a trade, there is a counterparty that takes the opposite position and thousands of trades are being conducted every minute of the day from 5 a.m. Monday morning when New Zealand opens to 5 a.m. Saturday (SG time) when New York closes.

On such a scale of activity and volume, the industry axiom is that FX is impossible to manipulate or control in any way and how shaken are we (or not) that the Department of Justice and the Federal Reserve will be taking action on 6 banks for their roles in rigging the FX markets.

So far, we have had banks netted for rigging LIBOR, cheating on sub prime mortgages, found guilty for misconduct in ABS (asset back securities) sales, an overhaul of the gold and silver fixing last year and, separately, a gold and silver market rigging scandal exposed in Dubai earlier this month. This does not include all the stock rigging and insider trading scandals that we get on an almost daily basis.

It is easy to understand how LIBOR could have been rigged because of the way fixing was managed, via a select group of traders who are known to each other. It is easier to understand how ABS could have been manipulated because the pricing of bonds and securities are not available to all and sometimes run on complicated valuation models that even regulators find difficult to understand.

I have always thought it was easy to cheat at FX from the start, in my hazy almost dream-like recollections of the old days, because I am not prepared to take any oaths on any stands for saying this.

Imagine a scene where a desk of traders get together and compare the list of stop-loss and take-profits levels left by clients each day. Privy information that is not known to most of the world. Imagine if you shared this information with a friend from another bank who would return the favour with their lists? Is that rigging?

And yet, that would never be proven because records do not date back so far to days where phone recordings were patchy and mobile phones were allowed in the dealing room.

Front running – putting on a position ahead of deal one was aware of for personal profits i.e. against the interest of the client who deal one was supposed to execute.

It has happened to little consequences in the past for small deals to big deals that possibly involved a central bank from my vague recollections. I imagine that the group of traders got away quite easily and the scandal hushed up for reputation reasons.

In more recent years, banks moved on to electronic trading platforms which appeared more reassuring to clients. Hundred of electronic platforms are available out there these days but electronic platforms are, too, manned by someone ultimately and there are folks hired to just make that 0.00001 cent profit on those billions that pass through daily.

Can we blame them when it is a zero sum game and the person at the other end of the trade is looking to profit from their bad judgement ? What if the person at the other end is a big bad hedge fund like naughty George Soros who “broke” the Bank of England that led to Black Wednesday back in 1992?

Let’s say, a certain head of trading at a bank decides to call his friend who happens to be a hedge fund client and discuss trade ideas and say, they decide to use their collective risk limits to push a certain currency in a certain direction, knowing that the market positioning is in the opposite direction. Is that rigging or fair play? (The head of trading would most probably be retired by now)

Bad luck that the 6 banks got caught because we are in a new world now. The world of algorithmic trading where there are no chats and no phone calls involved. Just computer programmes that are coded never to lose money until a better programme comes along, I suppose.

Enter the world of VIRTU (VIRT US) that IPO-ed earlier this year – atrading platform that has lost money on just 1 day in 6 years!

Can the regulators catch the computers that have been made famous in Michael Lewis’s Flash Boys?

Plug all those stop-loss and take-profit orders aggregated across the FX platforms into the system with no human intervention. Even better, throw in those dark pool orders (yes, I know that dark pools are better for securities). What we will have is something we are seeing with more frequency these days – excessive spurts of volatility like I observed in the EURUSD for one day last year, quite accidentally for I am no sleuth crusader.

One would have lost money being long or short if one did not escape in time.

Now, we have reached the part for my own story.

I have been a victim of all these fixing scandals, losing money on the various rigging scandals both for the bank and in my own capacity. Sometimes I was lucky to be on the right side, but more often than not, particularly in interest rates, I was on the wrong side. But I was never recompensed.

The fact is that most of us have been victims in one way or other, directly or indirectly (e.g. housing loan fixings) and even, remotely. The fines will never compensate the world for their losses – major or minor.

At this juncture, I do not know what is right or wrong and it is a very fine line these days to suggest that rigging exists or existed and if it did, why only for those few years that were under investigation ? Are we going to haul up old traders for their misdemeanours back in the 80’s and 90’s or are we going after the computers and robots next?

Shall we start going after central banks too? Manipulating currencies like the Swiss National Bank did earlier this year? When the last SNB chairman’s wife made a killing on the previous peg?

Can we blame it all on capitalism? That systems are created to be exploited? That “if you ain’t cheating, you ain’t trying”, as a Barclays trader was quoted for his part in the rigging scandal?

All I know is that the axioms of Too Big To Fail has been debunked with Lehman and Too Big To Be Manipulated has been disproved with this FX scandal but the market casino will still go on like it has always had.