Thoughts on ‘Squid Game,’ Common Prosperity and Wealth Taxes

Walking down the Rail Corridor, it is most normal to notice hulking HDB flats flanking one side and mighty mansions on the other, one housing hundreds of families and one housing just one or perhaps two.

This weekend would have been a good time to write about that surprise MAS move to tighten monetary policy on Thursday, which caught most of the market off guard. But for the past week, there is nothing on our minds and in our faces more than Squid Game with an onslaught of memes, gifs, headlines, op-eds’, jokes, costumes, pop-ups, even ang ku kuehs and crocheted dolls.

The most-watched show in Netflix history and number 1 in 90 countries. We had scoffed it off when it was launched, not being a K-drama or K-anything fan, for its ridiculous title and plot, which sounded like a cross between Battle Royale and Hunger Games—thus, another wannabe copycat.

Impossible to ignore any longer, we binged the entire series—now we can see why Squid Game resonates in 2021 and not in 2020, 2019, 2018 or any time before. Not because it is a story about a bunch of adults who have lost in the game of life, making death by childhood games a viable alternative, but perhaps because the Covid-19 pandemic has made many of us aware of the despair and misery around us in a world where some people have gotten disproportionately richer in the past two years while watching businesses crumble, livelihoods lost and families broken.

We have a middle-aged Korean bum whose luck ran out and over his head in debt, a rogue trader also over his head in debt, an elderly man with a terminal disease, a refugee, a migrant worker, unrepentant criminals and the nihilist millennial. All have a good reason to choose death or murder over the bone-chilling despair of living, for the chance at riches, manipulated by the hands of an elite upper class. And we see the same cracks in societies today.

Looking around Singapore, we never had so many super sportscars and Rolls Royces around. We need not wonder where the money is coming from just because we missed out on the crypto and everything else rally, for crying aloud about our inflating electricity and grocery bills. Youngsters are walking into private banks to open accounts in their sweatpants because Singapore is now the de-facto crypto/NFT hub for the region and we have SPACs listings next to mint more obscene wealth, literately or illiterately.

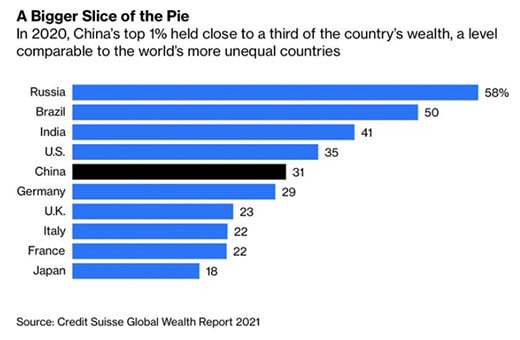

Common prosperity is in our faces now as China takes up stakeholder capitalism to reduce income inequality and rein in billionaires as we keep getting reminded daily that 1 per cent of the world’s population owns 46 per cent of global wealth. Even worse, 85 per cent of global wealth is concentrated in the hands of only 12 per cent of the world’s population. Or how about this one? The top 1 per cent of Americans own a record 32.1 per cent share of US net worth, or $45.6 trillion. The bottom 50 per cent of Americans own 2 per cent of US net worth, or $2.8 trillion. Or this? Top one per cent of U.S. earners now hold more wealth than all of the middle class and the bottom 90 per cent hold 91.9 per cent of all debt.

Even Pope Francis has been weighing in on the issue of the wealth gap, which has seen the poorer countries marginalised during this pandemic in terms of vaccine distribution.

Singapore is pushing for wealth taxes that are not income taxes as early as next year as US President Biden rattles his sabre at the billionaires and corporations evading taxes. We wonder why the urgency of China’s drive, which may be surprising to the world (but not to us) because billionaires like Ray Dalio have been talking about the need for him to pay higher taxes for a while and Paul Tudor Jones has been vocal since 2015 about how income inequality divide will end in either wars, revolutions or taxes.

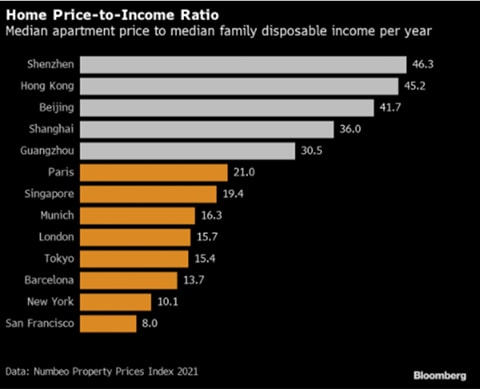

The global housing market is broken and dividing entire countries as the dream of home ownership grows more distant by the day for younger generations without the help of their parents or a windfall as incomes do not keep up. It takes as long as 15 years to save up for a deposit on a new home in Australia for first-time buyers. And it is likely to take longer if inflationary pressures caused by supply chain disruptions and commodity prices that we are witnessing in the past months continue to eat into savings. Australia is not even close to the rest of the world if we check the home price-to-income ratio on the chart below.

Indeed we have a mini-revolution right now.

— No house, no children? Birth rates have collapsed globally from China whose population is projected by some to fall by half within 30 years, to the UK, US and more. The outlook is dire as a recent survey conducted by the Communist Youth League reported 44 per cent of urban women respondents between the age of 18-26 said they do not plan to marry while 25 per cent of men said the same.

— “Generation Gamble” phenomena around the world starting with South Korea where younger Koreans, facing grim economic prospects, bet that speculation is the only route to succeed financially.

— The rise of Crypto-mania as a “jihadist call” against dollar and the institution, as Citadel’s Ken Griffin sees it as voters lose faith in governments nearly everywhere, which is unsurprising given the personal trading scandals that surfaced in recent weeks involving US House Speaker Pelosi to members of the Federal Reserve and the Pandora papers report earlier this month.

— China is struggling with an entire generation of millennials who are choosing to “lie flat” and embrace “passivity and step back from intense competition” as social mobility stagnates in the face of ossification of social classes.

— Violent crimes have spiked in places like America, which is attributed to social-economic changes possibly brought upon by the pandemic—leading to a widespread sense of desperation to fuel social friction and crime.

— Job quit rate hit new records in places like the US for August as employers struggle to find staff as the supply chain disruption continues to plague the world. A Mckinsey report found 40 per cent of employees surveyed were likely to leave their jobs in the next three to six months, many without having a new job in hand as the appeal of self-employment grows.

Our Thoughts

These are just some of the trends China is clearly paying attention to or at least taking action on as other governments watch on, some quite helplessly.

Yet, going by the popularity of Squid Game, we can expect the attention that the Arab Spring and Occupy Wallstreet failed to garner because the case is laid ever so bare now in the backdrop of the Covid pandemic.

To go off trajectory, yes, the state of affairs in Mexico would make Squid Game feel at home with 100,000 missing and unaccounted for on top of a murder rate of over 30,000 a year; bodies found strung up on bridges or tossed on roadsides, torture techniques fondly nicknamed—all of which are mostly attributed to the drug business that services wealthy America.

Maybe we are overthinking Squid Game or maybe it will herald a new Arab Spring. But we cannot help but wonder how governments and corporations can get their hands on so much money in debt sometimes, without repercussions (unless you are as poor as Argentina or Venezuela, etc.)?

Since we wrote about “The Gods Must Be Crazy, but China Seems to Be Doing Some Things Right” back in June, it has been an avalanche of policies and directives out of China and the rest of the world seem to be doing some catch up because people are starting to sit up and take notice.

There are two ways to reduce income inequality, one is to make the rich poorer and the other is to make the poor richer. Chinese billionaires have lost quite a bit since, as we had concluded that the Chinese initiative would bode badly for shareholders back in June.

Here is the list of some of the things we would expect in the years ahead using China as a playbook.

- Higher wages, whether it is a result of disruption or policies (and also due to population trajectories)

- Antitrust actions against big tech and monopolies

- Wages would cut profit margins but governments would play a more active role in managing prices and inflation if corporations tried to pass on the costs

- Lower productivity as government initiatives to improve work-life balance and quality of life kick in

- Innovative measures to reign in runaway real estate prices

- Crypto market regulation

Wealth taxes are coming for Singapore, but we would expect a lot of protection for the “progressive” industries like cryptos and tech, which means that the traditional asset classes would be more affected. We cannot be sure but it would be plausible to expect if we observe the number of US corps moving their HQ to red states like Texas.

It also portends that the very rich will be unscathed as we would expect for everywhere else around the world, with the middle class likely bearing the brunt for their geographical immobility.

Squid Game is probably the first we will see of this rich-poor genre series as TIME magazine rightly pointed out, that suddenly, everyone we see on TV is very rich or very poor.