Total Eclipse and The Market Crashes

– The summer stock rally is finally losing its resilience

– Russell 2000 Index has fallen below its 200 day moving average

– Depression is now the world’s most widespread disease

– Politics, terrorism, debt and despair over the future add to stress and anxiety

– Depressed folks make poor investors and spend more

– Passive investing does not require much thought but promotes inefficient allocation of resources in the economy

– World’s largest pension fund is preparing to put more money to work with active fund managers

– There is more for us to be anxious about as job security fades

– We should see a market correction at least

Market Bash: End Of Summer and Signs of Cracks

Since we wrote about Stock Market Defiance and The Coming Crash just about 3 months ago, we missed 3% in profits (to the peak) for the markets to come back to down to square one.

Graph of S&P 500

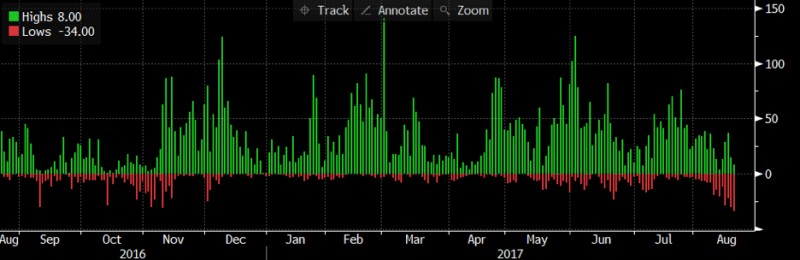

Summer is coming to an end, kids are going back to school and it finally feels like the infernal wait for a stock market correction is coming to an end because, finally, “the S&P 500 has swung at least 1% in 3 of the last 6 trading sessions after spending the previous 3 weeks without a move of more than 0.3%.” which happens to a 22 year record according to the WSJ.

The Russell 2000 Index (a broader representation of the entire market) has fallen below its 200 day moving average for the first time since June 2016 as the Hindenburg Omen re-appeared in perfect timing for the great American total solar eclipse next week.

Source: Zerohedge

Bearish voices are emerging as the number of stocks in the S&P 500 hitting 52 week lows outpace stocks hitting their 52 week highs, along with 6 other reasons to run for cover including Gold prices, the VIX Index renaissance, the Russell 2000 Index (mentioned above), the weakness of Dow Transport Index (key in the Dow Theory), the Hindenburg Omen and of course, Donald Trump.

Source: Marketwatch

Feeling Depressed?

Depression rates are going up and will go even higher for the global population as depression is now officially the most widespread disease in the world and would we not be feeling depressed after the happenings this week, unless we happen to be one of the lucky few who had put their entire net worth into Bitcoin this year which made history in breaking US$4,500 and returning 322% year to date.

Source: Fortune Magazine

A crazy week it has been for us, running from 1 depressing worry to another. An act of terror by a white supremacist in Charlottesville last weekend created unintended consequences for the President of America to alienate his allies which ended with the White House scrapping 3 business councils (so far) – infrastructure, strategic and policy and, manufacturing – after a spate of resignations of at least 15 CEOs’. Carl Icahn became the latest big-wig to resign from his advisor role although eyes are all trained hard on National Economic Council director, Gary Cohn, who was blamed for lower stock markets on Thursday because of resignation rumours.

Not all was bad, as news of Steven Bannon leaving the White House led stock markets to gains and Donald Trump hired a 28 year old former model as the 4th White House communications director since he took office and we really should take some time out to thank Kim Jong Un for doing nothing on South Korea’s Liberation Day on 15 Aug, preferring to wait for his US enemy to implode from within instead of wasting nukes.

We should also be thankful that we are not hungry Venezuelans, resorting to eat their zoo animals instead of venting about Singapore’s MRT that staged an epic fail on Friday morning, after warning signs on Thursday evening that caused some poor PSLE candidates to be late for their exam sitting. It is just too depressing to imagine the mental stress the 12 year olds had to endure as our thoughts go to the folks in Yew Tee who had to UBER their way to town on Friday morning for $63 and our sorrow extends to the folks affected by the latest acts of terror in Barcelona and Finland.

It is a timely reminder for us from the Straits Times this week that Singapore’s children experience significantly higher anxiety levels than global average, another achievement to add along with their high achievements in Pisa tests.

Source: The New Paper

Depression is a Global Epidemic

We have been broaching on the subject of stress and mental disorder since last year when we wrote about Singapore’s workplace stress and unemployment in Eat, Pray, Love – Stressed Out Singaporeans and The Singaporean Economy.

Stress-induced diseased like diabetes and hospital visits are on the rise.

“72 percent of employers in Singapore consider stress and mental health an issue affecting productivity, yet only 51 percent have emotional and psychological wellness programmes in place, according to the APAC Benefits Strategy Study 2017 by Aon, a leading global professional services firm providing a broad range of risk, retirement, and health solutions.”

Source: HRASIA

A poll by Mercer says Singaporeans are less happy with their employers than the global average.

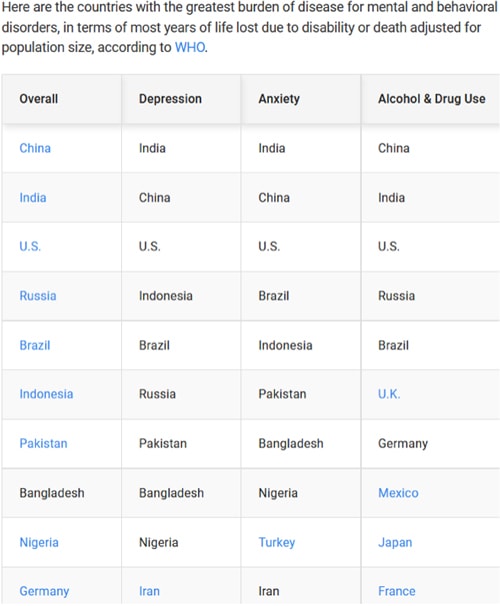

While it would be wrong to plainly assume that Singaporeans are generally depressed just because they are stressed or anxious, depression is becoming an epidemic of global proportions according to the World Health Organisation with more than 300 million suffering depression globally, with many more undiagnosed.

Source: USNews

We suggested in an earlier post this year, The Mental Health Problems of Debt and Despair, that besides the unusually high levels of social and political instability or the wealth gap, that could be attributed to heightened stress levels, debt and despair over careers and ambitions has also played a part in causing mental health problems which, at worst, leads to suicide (or perhaps suicide bombings or acts of terror)?

Politics and terrorism have added a lot of stress to our lives in the past few years and it does not give the world a lot of hope that the president of the United States is starting to look suspect with his congress looking to set up an expert panel to consider his mental health.

The photo circulating on the web below is telling enough of his increasing isolation.

As the NY Times quoted Yale dean of leadership studies, commenting on Trump’s tweets on the first CEO who resigned this week, that “never in history has a president attacked and threatened the chief executive of a major U.S. corporation like that.”

It looks like we are not the only ones going a bit mad?

The Other Thing—Collective Madness

Based on the WHO report, there are a lot of disenchanted people out there these days, a lot more than a decade ago or even during the crisis. We do not really need a lot of proof that social moods are souring leading to the rise of populism, with the process catalyzed by global connectivity.

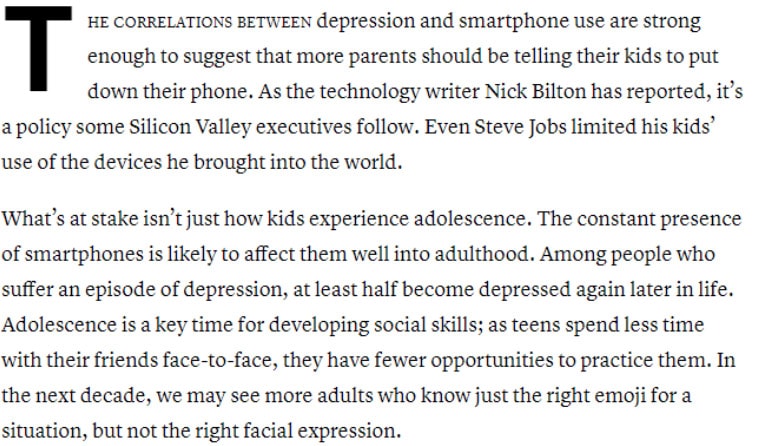

Excessive social media usage and smartphone addiction lead to depression too and there is so much anecdotal evidence gathered that those of us who were born in the eras before cannot help but agree.

Suicide is the second leading cause of death in 15-29-year-olds—WHO. Yes, for those who do not remember another life and another time.

Is that why stock markets have rallied like there will be no tomorrow?

A friend in Korea commented on their soaring stock markets, that nobody could be bothered because studies say they have 6 minutes to live from the first launch of a conventional missile and since nobody wants to live in a wasteland, they might as well prepare to die.

There is also an argument on Quora that depressed (“sad”) people spend more money (and make poor investors). Books have been written as we see from the excerpt of the interview with an author below.

Source: Frugality for Depressives

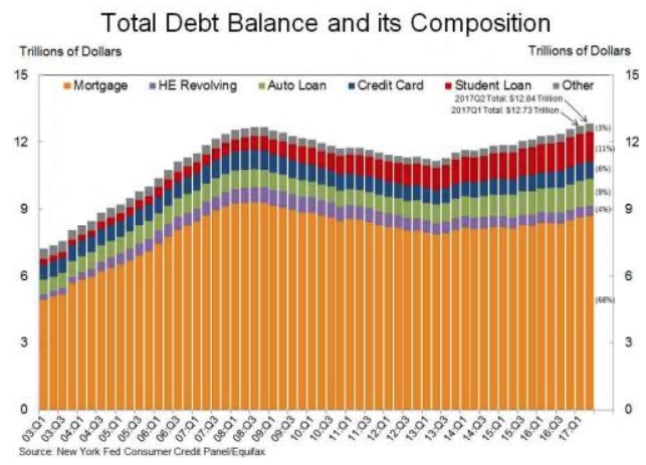

We need to look no further than US household debt balances which hit a new record in 2Q17 that is enough for the New York Fed to describe as “a persistent upward movement not seen since 2009”, undoubtedly adding to stress levels.

Source: Zerohedge

Margin debt for the NYSE is at record highs but we are not sure if we can generalise that the debtors should be stressed or depressed.

Graph of NYSE Margin Debt Balances till 2Q17

One or Two More Reasons to be Stressed About Markets

It’s all about lost hope for the future, depression in the status quo and disillusionment with the market which has given rise to passive investing and the ETF indexed based world that does not require much thought.

Yet a Morgan Stanley strategist has sounded the alarm at the blistering growth of passive investment because outflows will be exacerbated when trouble hits, especially with the massive growth of algo-funds (a topic we will save for another day).

Source: CNBC

It is large enough a problem for the world’s largest pension fund, Japan’s GPIF (Government Pension Investment Fund) to recognise and is preparing to put more money to work with active fund managers to maintain market efficiency as we speak.

“If investors continue to pile their money into passive index-tracking, at some point markets will stop doing their job of allocating resources efficiently in the economy.”

Source: WSJ

No. We are not safe in Bitcoin too, just to add to your list of worries, because, on Friday, Australia has just decided to follow Japan’s suit to regulate Bitcoin or digital currencies, in general.

Source: FT

Who would blame them when the price action has been just a little mad?

Singaporeans Need Mental Health Day

MRT and PSLE troubles aside, 560 lucky Singaporeans will become instant millionaires this week when Tampines Court goes an en-bloc sale for S$970 mio, the biggest deal in a decade.

Yes, it is obscene enough to make the many not-so-lucky Singaporeans depressed, discounting the 244 families we mentioned 3 weeks ago who pocketed S$2 mio for their Serangoon en-bloc sale.

For you see, 83% of Singaporeans said the concept of permanent employment is gone and sees job changes as a given which adds to their stress and anxiety levels. Perhaps part to do with their mortgages and bills, besides the exorbitant UBER bills on days when the MRT breaks down?

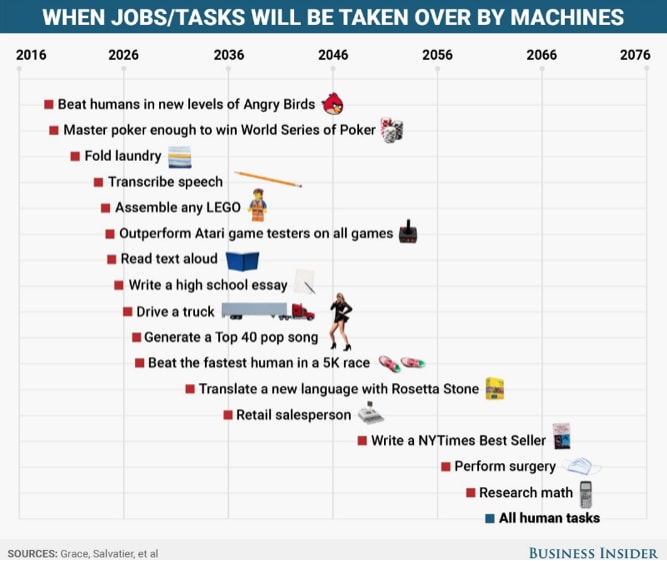

They are not wrong if we look at this graphical depiction of when machine skills will overtake human skills, depressing as it is for the immediate job security of a professional poker player.

Source: Business Insider

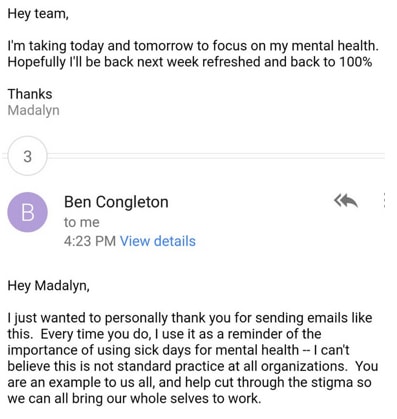

The world is warming up to a concept of mental health days off, just as universal basic income is being explored. A correspondence between an employee and her boss has gone viral on the web with much praise heaped on her understanding superior.

Source: Huffington Post

If we use WHO numbers on productivity lost, there may be a case to be made for mental health days off in the future especially when depression as a disease is forecast to continue spiraling higher.

Total Eclipse of the Market

Folks are saying that markets will rally if Donald Trump quits in their collective mad logic. It is hard to fault them there even if it is just purely a sentiment thing and nothing fundamental or technical about that analysis.

While we cannot claim to be expert political analysts who are able to forecast markets as well, we can at least claim we are not too blinded by depression to maintain our view for the last 3 months that we have an uncertain outcome ahead. An outcome that will lead to at least a market correction ahead for all the reasons mentioned at the beginning of this post.

The topic of depression was brought up to echo the point we have been trying to make, that it has become too big a problem for us to avoid when assessing the markets and investor behaviour for the present and the future.

Why now, at the end of blistering summer, after a fairy tale rally that has lasted more than 8 years, where buying the dip has worked well for the last 100 months? We cannot be sure but there is nothing like a total eclipse to shake things on 21 August 2017, the first coast to coast total eclipse in the United States in 99 years that will check in on Jackson Hole, Wyoming.