Welcome to the Roaring Twenties. Are You Ready for It?

“If you look back at the stock market over the past 350 years, you’ll find that in each Century, the Twenties have always enjoyed bull markets in equities; this rings true for the 1720s, the 1820s and the 1920s. Unfortunately, as we’ve seen with bull markets across many asset classes, these dramatic bubbles came crashing down by the end of the decade.”—Dr. Bryan Taylor

12 days into 2020 and we cannot keep up with the pace of everything that’s happening. We had the killing of Soleimani, then Iran manages to accidentally shoot their own airliner out of the sky fully loaded with 176 passengers and sent missiles to miss all their targets at the US bases—sending the Dow Jones above 29,000 for the first time ever, giving Donald Trump a great win.

Meanwhile, Australian bushfires continue to rage, merging to form ‘megablazes’ and creating their own weather systems as Carlos Ghosn overtakes Jho Low as the world’s most famous fugitive whose escape from Japan to Lebanon will make a great plot for a book or movie for him to cash it in.

Conflict and confusion grow daily because for every article that tells you drinking 7 cups of coffee a day is good for cutting your chances of early death, there will be research that tells you it is also linked to early death. Wine is good and then wine is bad, bad, bad. Donald Trump is a hero, a crook, a liar and also God. It is bad to sleep with wet hair, intermittent fasting is key to treating a variety of health conditions, magic mushrooms can cure depression and eating chillies cuts the risk of heart attack and stroke.

Last week the Iraqis were chanting “death to America” for the death of Iran’s Soleimani but this week, Iranians are protesting against their own government?

Source: CNN

Source: CNN

Thus we have a good friend who flung her hands up, admitting, “I don’t know how to trade anymore”, when we asked about markets for 2020. It’s all up to Trump.

There will be no recession in 2020, according to the experts in the financial markets.

Source: Visual Capitalist

Source: Visual Capitalist

Yet in a survey of nearly 150 CFOs, 97% of them say that a downturn (either a slowdown or a recession) has already begun or will occur by the end of 2020.

Source: CNBC

Source: CNBC

“The Bear Market is in fundamentals, not equity prices. Corporate profits, both pre- and after-tax, are no higher than in 2013; yet the stock market has soared 130%.”—David Rosenberg

For the ATH (All-Time Highs) in the stock markets and economic expansion and jobs growth both longest in history with the unemployment rate at a 50-year low, the percentage of US-listed companies losing money over 12 months is close to 40%, its highest level since the late 1990s outside of post-recession periods with US retailers announcing a 59% jump in store closings, according to Coresight research and the highest mall vacancy rate of 9.7% since records began in 2000.

There is something about feeling helpless in the world of 2020, which is akin to us watching atrocities committed by errant drivers on the roads and getting hit by the injustice when a bus driver decides to use his dash cam to implicate you for the harmless offence of crossing a double white line.

It is the Age of Unreason!

Yes, and we are no longer surprised that Donald Trump would take credit for a decline in cancer deaths (while suicides and overdoses skyrocket) because we have started to doubt ourselves these days—that we are wrong about everything happening around us for the faith of so many out there.

The 1720s, 1820s, 1920s and 2020s

Most of us only remember 1929 and the Great Depression but taking a peek at history, for the past 3 or 4 millennia, if we include the Tulip Mania bubble that finally burst in 1636, which does not count as the second decade of each millennium, some major financial crisis of sorts would surface after fierce bull markets.

Source: Global Financial Data

Source: Global Financial Data

1720 – South Sea Bubble and The Mississippi Bubble

1819 – The Panic of 1819 was the first major peacetime financial crisis in the United States which was followed by a general collapse of the American economy.

1825 – The Panic of 1825 was a stock market crash that started in the Bank of England, arising from speculative investments in an imaginary Latam country that spread to Europe, Latin America and the United States.

1929 – Wall Street Crash of 1929 and the Great Depression

There was a pattern behind all the bubbles.

“The bubbles of the 1720s, 1820s and 1920s were amazingly similar. In each case, wars had created excessive government debt. Governments inflated their way out of their debts in France in the 1720s, countries like Austria in the 1820s, and Germany in the 1920s. Investors found new investment opportunities abroad, in trading companies in the 1720s, South American companies in the 1820s and in the United States in the 1920s. Both government debt holders and equity investors lost money as a result of these bubbles as governments defaulted on their debts and share prices collapsed. In each case, it was decades before markets began to recover.” Source: Global Financial Data

In 2020, replace “war” with “Global Financial Crisis”, keep “excessive government debt” and “inflated their way out of their debts” with zero and negative interest rates, replace “new investment opportunities” with “FANG, unicorns, Bitcoin, etc”.

So we started 2020 with a roar, corporations sold $69 billion in investment-grade debt this week, the second-highest amount ever in a one week period according to BofA Securities just as the World Bank warns on the fastest increase in borrowing since the 1970s.

Source: CNBC

Source: CNBC

Yet it is perhaps all right since the world is coordinating to inflate its way out of this huge debt load because we had 51 central bank rate cuts over the past 6 months, the most since the financial crisis out of US, Denmark, Australia, Brazil, Russia, India, China, South Korea, Mexico, Indonesia, Philippines, Thailand, Chile, Turkey, Malaysia and more.

We are not in the business of forecasting. Rather we are pointing out that history is sometimes “interesting”. As our national papers said, we will do better as investors if we ignored market forecasters especially the “Armageddonists” between 2010 and 2019 although it is just 2020 this year.

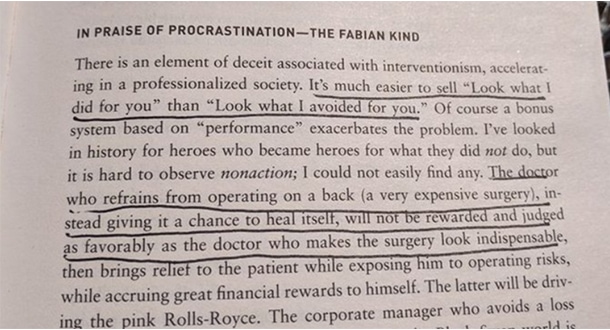

It is true. While we will not ignore the doctor as a naysayer, it is much easier to sell “look what I did for you” than “look what I avoided for you” because the “doctor who refrains from operating on a back (a very expensive surgery), instead giving it a chance to heal itself, will not be rewarded and judged as favourably as the doctor who makes the surgery look indispensable”. This is from none other than Mr Black Swan, Nassim Taleb, in his other book, Antifragile.

Source: Movement Capital

Source: Movement Capital

Why would we buy away?

It is a risk-free market anyway.

Source: Marketwatch

Source: Marketwatch

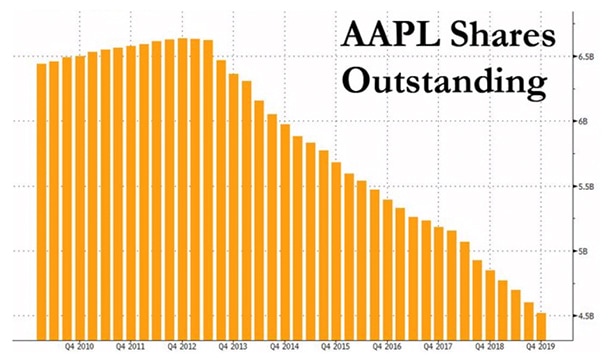

Apple Inc’s outstanding free float has dwindled into nearly nothing, having bought back all those shares. At this rate, Apple will be completely private by 2030?

And it is not only Apple, but corporate America has also announced a whopping $1.2 trillion in float shrink in 2019. That figure marks the 4th time in the past 5 years that new cash takeovers & new stock buybacks have topped the $1 trillion mark via Jennifer Alban of FT on Twitter.

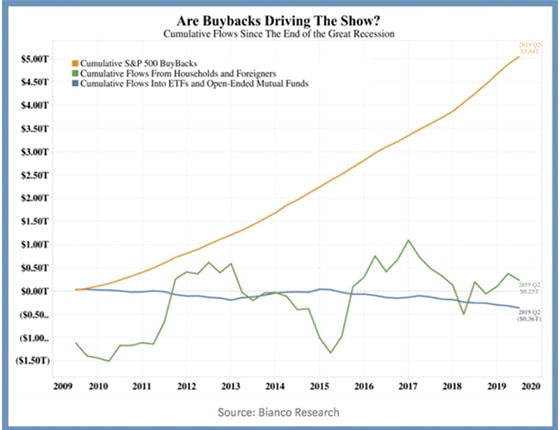

As shown in Jim Bianco’s chart below, large companies have kept the Ponzi afloat to date by using their cash flow and record borrowing to buy their own shares, while the relative flows from households and foreigners, ETFs and mutual funds have stagnated.

Source: Bianco Research

Source: Bianco Research

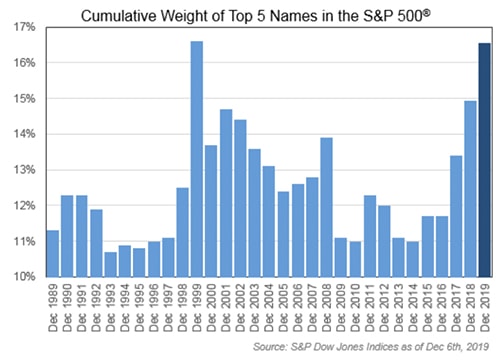

And it is good to be bullish if they are doing all the buybacks (and if Apple will be private by 2030) because the S&P 500 has not been so top-heavy with just five stocks (Apple, Microsoft, Google, Facebook & Amazon) accounting for 16.5% of the index, the most weight since 1999.

Source: Trade Narrative

Source: Trade Narrative

“Welcome to a world in which everything you learned about risk/return analysis in business school is not only worthless but detrimental to your career path”—Danielle DiMartino Booth (Fmr Federal Reserve)

The old school method of analysis and valuations does not work in the new world where it is all about chasing headlines and central bank speeches. It is a business risk if you are too smart.

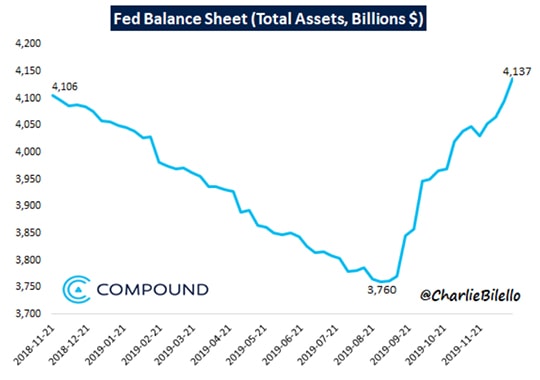

And the chart below is the one to follow for the rest of the year.

Source: Twitter

Source: Twitter

And Warren Buffet is still sitting on $128 billion (up 3 times since 2016) even though he was born in 1930 (not 1929)?

Source: CNBC

Source: CNBC

Our 2020 Resolutions

How much more Moutai can the world drink? A lot more! The stock has near doubled in a year but the world can afford to drink more these days with “we may never make a profit” Uber encouraging drinkers out there. Anheuser-Busch InBev, Diageo, Suntory

Sources: Google, Worldstopexports, Citylab and CNN

Sources: Google, Worldstopexports, Citylab and CNN

We are preparing to give up on social media and better manage our internet footprint because big tech is making us nervous about our privacy since everything is on cloud now and the latest Google deal giving it access to health data is just going to join their list of antitrust crimes.

We already shudder to think of the photos we take, all stored on cloud, resold to facial recognition companies to improve their algorithms when surveillance is now a fact of life in our iWatch, Siri, Alexa and our home appliances.

Even Charles Schwab and Robinhood are selling client order data for profit just so you get that free brokerage. Every aspect of life in the new tech world feels like a violation of privacy. Let the antitrust wars begin!

Peak social media it may be, but we have not “peaked” the mental health crisis yet. There are lots in store for us in the deaths of despair from work or lack of work and riots around the world that we would embrace insurance and healthcare because those are going to be in great or grave demand as we are sure the demand for mental wellness as prevention would be central to government agenda.

Source: NYTimes

Source: NYTimes

We may also have “peaked” unicorns. It’s shame because most are still not listed for those e-bike companies that folded and the e-scooters, hoverboards and all, as well as their sharing partners like Lime and Airbnb which are prepping for a listing.

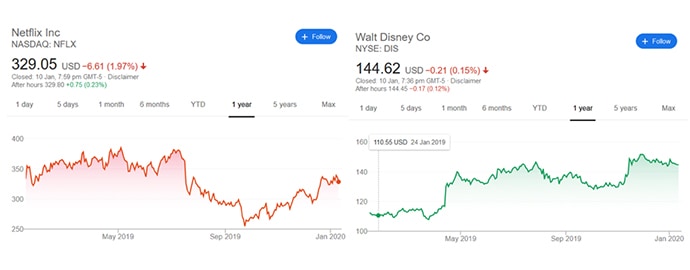

Yet, we would be expecting the incumbents to fight back after Disney’s remarkable showing against upstart Netflix this year and surely, Walmart will do something about its internet rivals?

Source: Google

Source: Google

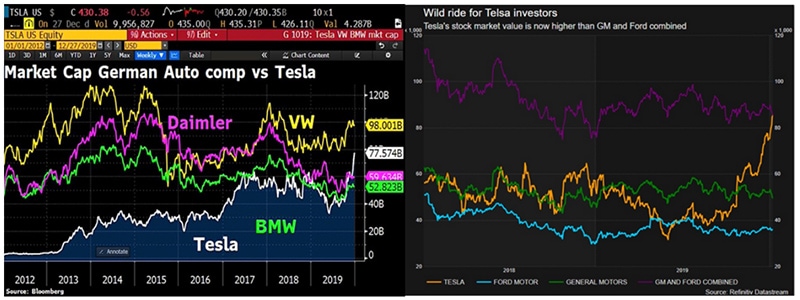

And we also do not think Daimler or BMW will be letting Tesla take all the glory for dwarfing both of their market caps, the market caps of Ford and GM combined and c on the heels of VW, without making a profit ever?

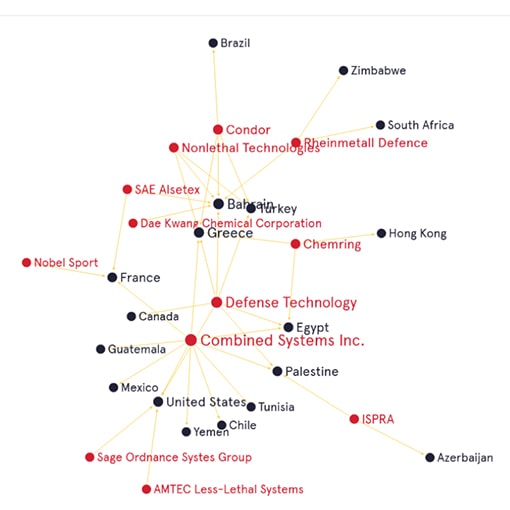

As for the riots and protests, we would think umbrella and laser pointer companies would be good ideas but good sense tells us that tasers/stun guns, smoke grenades and tear gas are more important.

Top tear gas manufacturers. Source: Graphcommons

Top tear gas manufacturers. Source: Graphcommons

Stun Gun Market. Source: Businesswire

Stun Gun Market. Source: Businesswire

Global distrust, nationalism and xenophobia are growing with the leading aerospace and defence industry even as 6 of the top 15 global defence companies are now Chinese and 8 are in the top 25. It is a top downtrend as NY Times reports, “Mark Villalta said he’s stockpiling firearms in case Trump’s re-election is not successful: ‘Nothing less than a civil war would happen,’ he said, his hand reaching for a holstered handgun. ‘I don’t believe in violence, but I’ll do what I got to do.’”

And we will do what we have to, when we cannot think of what umbrella stock to buy in support of protests and riots.

Source: Business Insider

Source: Business Insider

Finally, we will go with the Pope and Greta because consumerism is a necessary evil and it takes 2,700 litres of water to make a single t-shirt (how about that for a fact?) while Indian cotton farmers average more than 10 suicides a day and single-use plastics are the biggest pollutants.

Source: Reuters, TIME and Repurpose.org

Source: Reuters, TIME and Repurpose.org

Pollution has been shown to make us dumber and harms the environment, which then leads to catastrophic events like fires and floods… as if microplastics and air-borne particulates are not harming us already. Do we need more healthcare and insurance?

We will not even talk about plutonomy and the wealth gap because it has become an intellectual gap and we managed to impress ourselves without a single mention of global politics. It’s all up in the air. Welcome to the Roaring 20s!

You don’t have time to “keep up” with all the irrelevant ephemera that marketers and manipulators want you to respond to. TV can go unwatched. Articles can remain unread. Trends can fade away unnoticed. Don’t react to things that don’t matter. Make time for your life.