The Future of Real Estate Investment: 2017 and Beyond

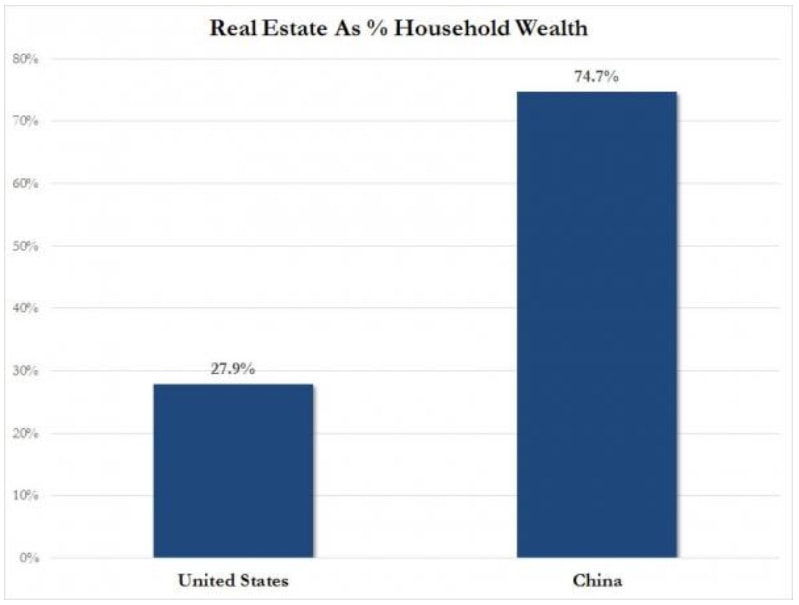

Tired of hearing about the property market with at least 1 email a day from local financial sites (no names mentioned), selling the same old tiring invest-in-real-estate ideas? It is possible that the property market is one of the most over-written about and over-analysed topics in our lives and who can blame Asians for harping on property when 45.8% of Singaporeans’ wealth is tied up in real estate, 75% for China (smog free zones or not), and just 28% for Americans?

From our post, Equity Focus: The Goat and The Real Estate Market, written earlier this year, we noted that for “Asians, real estate investment is in their blood and residential investment properties are by far the easiest to understand and manage for the average man on the street investor out there”.

We may be pleased to note that Singaporeans are diversifying themselves, as the 7th richest country in the world this year, and the richest in Asia, according to a Credit Suisse report. With each an average wealth of S$ 395,000, expected to grow at 2.2% per annum till 2021, residential property assets have fallen from 47% to 45.8% of household balance sheets with financial assets picking up the slack. We have just $833.5 billion of residential real estate assets versus $ 224.7 billion of mortgage loans, for a leverage ratio of just under 30%. Source: Singstat

When we fiddled with the idea of writing yet another property piece, spoke to serious investors and pundits, it just struck us that there is nothing really much to say unless it happens to be one’s main source of income like the legions of agents, sales people, real estate analysts or anyone gainfully hanging on to their employment in the real estate sector.

We have to admit, too, that we are not in touch with anyone looking to buy a property in the next 6 months, but for 1 young friend who is looking for an apartment on a strict budget of $1.5 million and not a cent more, because he does not want to be over-burdened especially when he does not feel secure in his employment.

The rest joins a growing pool of landlords from North Perth to Shanghai, cutting the asking rents on their various residential properties as leases come due for renewals. The mood has been replaced with one of caution and fear not just in Singapore but around the world.

This resonates with what our dear friend wrote about in Jul 2013 when she succinctly surmised that the sweet spot in Singapore housing is $ 2 million or, “Dual household income of USD 130k, leveraged at 80% and assuming a loan service interest rate of 3% (conservatively) will allow a 24 year mortgage on a magic number of SGD 2 million on a property.” And indeed, that now looked like the peak of the market.

To my dear friend who first brought up the subject of Singapore Property and The Poor Millionaire Syndrome back in 2012 when property made up 50.2% of household assets, which was followed by several pieces on a Singapore real estate menopause, calling the bluff on real estate and the widow maker in real estate besides a dozen other pieces, I decided to ask for her view on the future of real estate.

Just Ask The Kids

For it cannot be just a short-term view, but a longer term perspective, if we want to get it right and we could not be more surprised by the results when she suggested we talk to her teenage son for his naïve yet futuristic view on real estate.

The kid started by, “To me, buying a house or an apartment is like saying something about myself… like, I am making a statement on settling down in a place and have found myself and what I want to do for the rest of my life, and I do not see that happening…”

How fluid and unlike our times when the 5 C’s (condo, car, career, credit card and country club) were the consensual expectation that every young adult had to abide as their life goals that parents set us out on, failure to be met with some ostracisation within the social circle and society at large.

How sad but true for the children of now, when they instinctively grasp the fluidity of their times and that they need not read to know that EDB’s Yeoh Keat Chuan said, “65% of primary school kids today will have jobs that don’t exist yet, so it is critical to learn and reskill” and that IMF’s chief, Christine Lagarde told the WSJ that “66% of jobs that will be taken by young kids in school today simply don’t exist”, just as we wrote in our Halloween Trade Idea: Don’t Study So Hard, Learn to Think Instead.

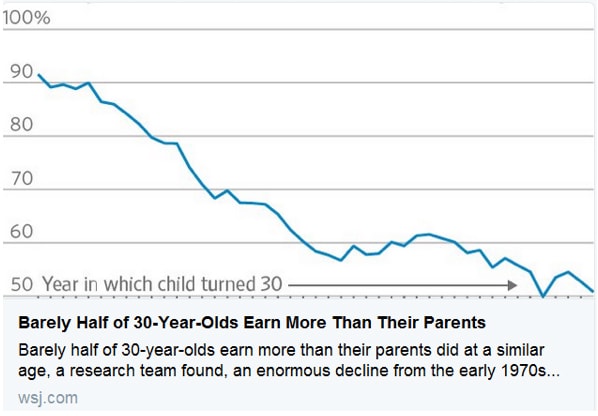

How can we expect children to set out life goals, which include property ownership when the future looks as bleak as the World Economic Forum pointed out, from a McKinsey study, that Young people are growing up poorer than their parents.

Source: McKinsey

Source: WSJ

The Answers Are In The Trend

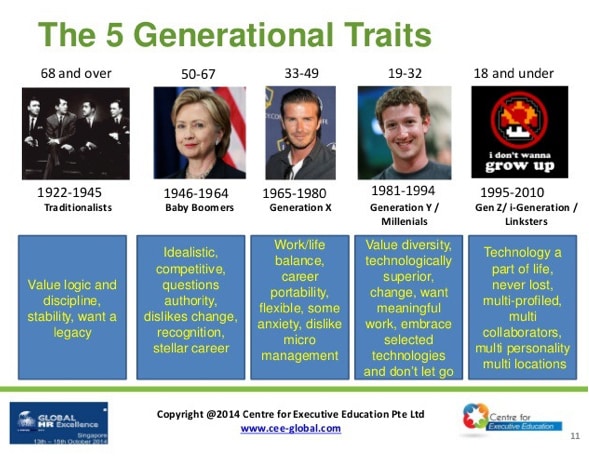

The new home buyers are Gen Y a.k.a. Millenials and the Gen Z crowd and they are a different bunch indeed.

US home ownership in the Millennial generation has fallen sharply and given that they tend to be city dwellers, working in flexible jobs which makes the idea of home ownership 1. Unaffordable and 2. Impractical, when balanced with their other life values which have attributed to the trend of later marriages and delay in having children.

Thus we have one-third of American millennials still living at home with their parents, a trend that is visible in Europe and increasingly, other parts of the world with pricey housing markets which means that two-thirds of young adults in Asia Pacific aged between 22-29 are living at home still, according to PropertyGuru.

Source: CS Monitor

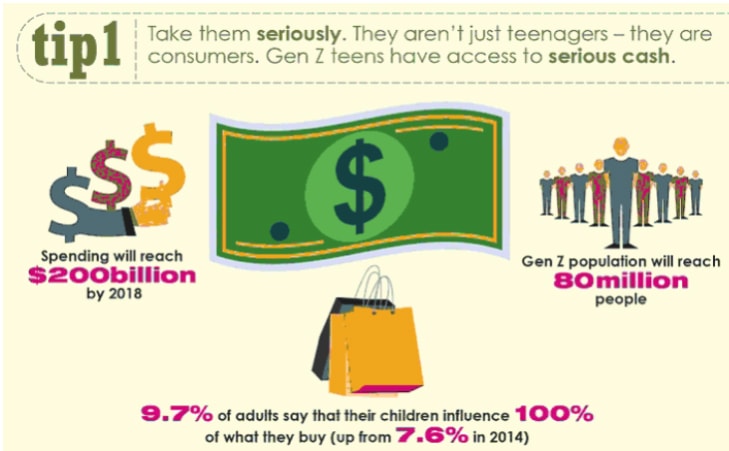

But move over Gen Y, because Gen Z are coming and they will be an upgraded version of the Y, a batch who are even more pragmatic and better multi-taskers, with spending power that exceeds prior generations.

Source: Vision Critical

“Gen Z also thinks and acts VERY different than their Millennial predecessors. In fact, Gen Z states that “they don’t want to end up like Millennials.”

Gen Z is already the most influential group of technology trendsetters. They offer an accurate glimpse into the future of communication, banking, shopping, learning, voting, working, investing, and much more.

Gen Z’s emergence is challenging managers, employers, salespeople, marketers, companies, and even their own parents (who are Generation X and Millennials).”— Jason Dorsey

Other Resources: Civic Science & Huffington Post

Source: Jason Lolarga LinkedIn

As home buyers, it would be hard to convince this sophisticated bunch, of which 11% suffer from ADHD, to invest in a home and encumber themselves with a 30 year mortgage for they have been “raised by more pragmatic Xer parents, Zs are encouraged to be more independent and strive to make their own way in the world at a very young age… teens today with their unprecedented access to this adult world by the age of 18 have made more decisions on their own regarding money and smart purchasing alternatives”, so dad and mom’s values and views, errr, matter less, condolences to my dear friend indeed.

Especially when career paths will be less certain than ever with uncertainty abound in the 4th Industrial Revolution that the world is on the brink of.

This is highly evident all around the world in global cities with the emergence of co-working and co-living spaces that have sprung up all around Singapore, that is making long-term office leases a thing of the past and we have to thank guerilla marketing and pop-up stores for taking a bite out of retail realtors who are already feeling the heat from on-line sales.

The main theme behind these pop-up stores and co-working/living concepts resonate with the values of impermanence that somebody we know terms, the “re-set button” in a disparaging observation on the current strawberry generation, a local term for pampered kids, and their rejection of the idea of losing which means they demand the right to press the “reset” button to “restart” the game. We disagree with that for the obvious reason that their life and career circumstances are vastly different these days, for all the truth in her belief.

What Now?

We asked the teenager again, what he thought of the latest co-living idea called Lyf, spelt correctly, by Ascott and whether he would want to give it a go one day.

Answer: “No, I wouldn’t want to live in that. I like my privacy.”

Yet another difference between Millenials and Gen Z?

Nonetheless, the facts do not bode too well for those single unit investments in the style of the past for us unless we have the capacity to scale up into a co-work outfit or something or that sort. Not with the economic slowdown that we are experiencing right now.

It does, however, look like multi-generation homes are the thing to be invested in although we cannot speak for some mainland Chinese we hear about with 7 homes in 7 different cities and only 1 child to live in them all.

Meanwhile luxury doomsday bunker complexes are selling well in Texas along with people signing up to retire on cruise ships, some for economic reasons and others buy a luxury floating apartment to work from, for safety, or just to get away from overcrowded cities and perhaps in anticipation of further global warming because the last time the world got this warm, sea levels were just 8 to 10 metres higher.

Possible alternative investments?

The Case for Singapore

Singapore does not have much to worry about even with the threat of a $100 Billion Chinese-made City Near Singapore that “Scares the Hell Out of Everybody”.

The Chinese have been buying up homes everywhere, in case we haven’t noticed and it is not just the Chinese, it is the Malaysians buying up UK and Australia, ranking as the 3rd largest investors and the Arabs buying up the US and UK, not to mention the Russians too.

Their motives are obviously different and other than investment, sometimes, perhaps more of a need to diversify themselves outside of their countries, having less faith in their economies and society and availability of resources as well as capital controls?

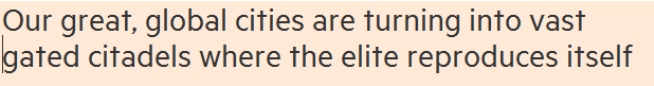

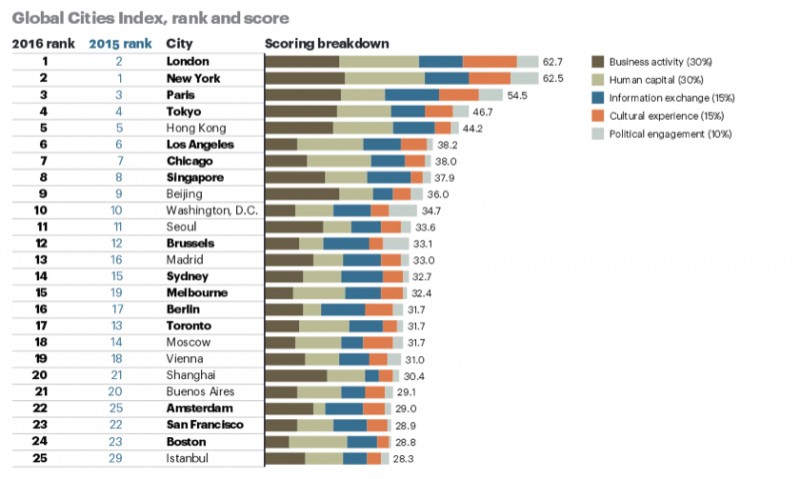

If anything, it is a good thing, driving up prices and producing safe havens in global cities like Singapore. As put by the FT, Our great, global cities are turning into vast gated citadels where the elite reproduces itself, noting that “New York, London, Singapore, Hong Kong and Paris are unprecedentedly desirable”.

While the article may stick to a populist view of plurocratisation, where “working classes and bohemians were priced out” in a “terrifying case of class-cleansing” and outside of these hubs, “things are less desirable”, it does make Singaporeans darn lucky to be living in a hub that is ranked 8th in the world by AT Kearney in 2016 (although we are not sure why Istanbul is no.25).

Source: AT Kearney, 2016

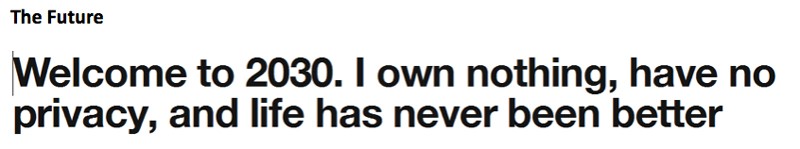

Thankfully, it is not true but just a World Economic Forum post which happens to be written by a Danish MP last month.

It echoes the same eerie refrain of the FT article, of the dystopian sort of Utopia in Aldous Huxley’s Brave New World. Who would guess what property ownership statistics would look like then? All in the hands of hedge funds or corporations, ensuring everything was in working order.

Not so much different from living in a bunker community or on a luxury cruise ship or the tropical paradise of Singapore.